ASE, Amkor Top OSAT Rankings But China Gains Ground

ASE and Amkor maintained their leading positions in the OSAT rankings in 2024, but vendors from China continue to gain ground

By Mark LaPedus

ASE and Amkor maintained their leading positions in the OSAT rankings in 2024, but vendors from China continue to gain ground in the market.

The outsourced semiconductor assembly and test (OSAT) vendors are an important part of the semiconductor industry. OSATs provide third-party packaging and testing services for the semiconductor industry.

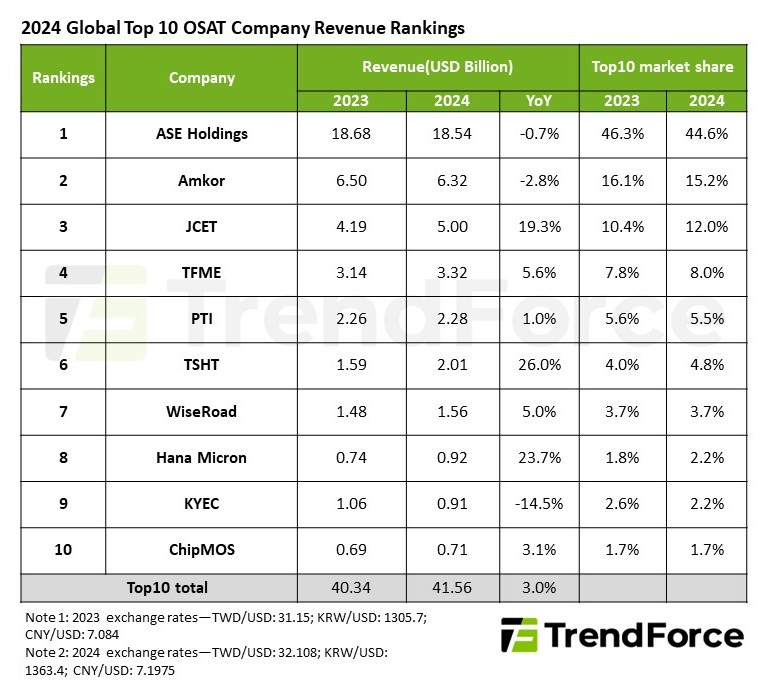

In terms of the rankings, Taiwan’s ASE maintained its position as the world’s largest OSAT with a 44.6% market share in 2024, according to TrendForce, a research firm. In 2024, ASE had sales of $18.54 billion.

Amkor was in second place in the OSAT rankings with a 15.2% share in 2024, followed in order by JCET (12%), Tongfu Microelectronics (8%), Powertech Technology (5.5%), HT-Tech (4.8%), WiseRoad (3.7%), Hana Micron (2.2%), KYEC (2.2%) and ChipMOS (1.7%), according to TrendForce.

TrendForce also revealed that the global OSAT industry in 2024 faced dual challenges from accelerating technological advancements and ongoing industry consolidation. TrendForce reports that the combined revenue of the world’s top 10 OSAT companies reached $41.56 billion in 2024, up 3% over 2023.

Last year, the market dynamics were different for each OSAT. Here’s how each OSAT fared in 2024:

ASE

It was a mixed picture for Taiwan’s ASE in 2024. “Sluggish recovery across smartphones, consumer electronics, automotive, and industrial sectors curbed packaging order growth,” according to TrendForce. “In testing, the company also faced intensified competition and the rise of in-house testing among some clients.”

Amkor

Last year, U.S.-based Amkor saw “lingering inventory corrections in the automotive segment and sluggish global vehicle sales. Although consumer electronics orders began to recover, intensified pricing pressure in China and Southeast Asia constrained revenue growth,” according to TrendForce.

JCET

China’s JCET saw its sales grow by 19.3% in 2024. “Demand for consumer electronics improved as semiconductor inventories began clearing in late 2023,” according to the research firm. “The ramp-up of new platforms in AI PCs and mid-range smartphones helped JCET quickly fill capacity for standard packaging services.”

Tongfu Microelectronics

China’s Tongfu saw 5.6% revenue growth in 2024, “buoyed by a rebound in demand for communications and consumer electronics. A strong performance from key customer AMD also supported revenue stability,” according to the firm.

Powertech Technology

Taiwan’s Powertech saw lackluster growth in 2024. “Growth was limited by the absence of a significant rebound in memory packaging/testing and the ongoing transition phase in advanced packaging,” according to TrendForce.

HT-Tech

Huatian Technology, now called HT-Tech, saw 26% revenue growth in 2024, which was the highest annual growth among the top ten OSATs. “The company not only mass produces low- and mid-end packaging but is also investing in high-end development, focusing on applications such as AI, HPC, automotive electronics, and memory, with a strong local customer base in China,” according to the firm.

WiseRoad

China’s WiseRoad saw 5% growth in 2024. Several years ago, Wise Road Capital acquired UTAC, an OSAT. But now, the parent company is considering a plan to sell UTAC, according to a report from The Business Times (BT) in Singapore.

Hana Micron

The Korean OSAT saw 23.7% revenue growth in 2024, supported by a strong performance from its memory customers.

KYEC

The Taiwan company saw a 14.5% decline in sales in 2024, mainly due to the sale of its subsidiary KLTech. “That said, growing demand from AI servers and HPC chips continues to support KYEC’s testing business, alongside growing CoWoS testing demand,” according to TrendForce.

ChipMOS

Taiwan’s ChipMOS rounded out the top ten with $710 million in revenue in 2024, “with its driver IC business benefiting from steady demand in the automotive and OLED sectors,” according to the firm.