Can China Make 5nm Chips?

China’s Huawei introduced a notebook PC based on a 5nm chip, but a market research firm has debunked those 5nm claims

By Mark LaPedus

China’s Huawei recently introduced a new notebook PC, which is powered by a chip that is supposedly manufactured using SMIC’s new and breakthrough 5nm process technology.

Initially, the announcement was said to be a major achievement for China. It represented the first 5nm chips that are manufactured by a Chinese company. SMIC is China’s largest foundry vendor.

But the announcement turned out to be misleading, as a market research firm has debunked those 5nm claims. The chip in Huawei’s system is using SMIC’s older 7nm process, not the 5nm technology as originally touted, according to TechInsights, a market research firm. In other words, the PC incorporates a 7nm chip, not a 5nm device. That’s a big difference.

To be sure, this is a complex, if not a confusing, story. Last month, Huawei introduced the Matebook Fold notebook PC based on its proprietary operating system. The PC is powered by HiSilicon’s system-on-a-chip (SoC), but Huawei didn’t disclose any details about the device.

But reports out of China indicated that the notebook is powered by HiSilicon’s 5nm chip, which is being manufactured by SMIC. China’s HiSilicon, a fabless semiconductor company, is owned by Huawei.

SMIC’s ability to manufacture 5nm chips would represent a major milestone for the company and China. For years, China has been behind in logic processes. But SMIC’s long-awaited 5nm process could help close the technology gap. This is important for China, as the nation is racing to develop advanced AI chips and other devices.

As it turns out, though, Huawei’s PC announcement is half true. Huawei’s new PC is indeed based on its internally-developed HarmonyOS operating system. But HiSilicon’s SoC, dubbed the Kirin X90, is manufactured using SMIC’s older 7nm process, not 5nm technology, according to TechInsights.

In other words, TechInsights debunked rumors of China’s breakthrough at the 5nm node. “Despite the rumors around Huawei’s Matebook Fold|Ultimate Design’s new X90 SoC possibly being manufactured using a breakthrough SMIC 5nm-equivalent (N+3) process, TechInsights can confirm that it was manufactured using SMIC’s 7nm (N+2) process node,” according to the market research firm. “With the device still manufactured using its N+2 process, this likely means that SMIC has not yet achieved a 5nm equivalent node that can be produced at scale.”

In fact, SMIC is struggling to put its 5nm process into production. The company can produce 5nm chips at low quantities, but the yields are poor. That could change in the future. But until then, China is stuck at the 7nm node—and is falling further behind in logic technology. At present, SMIC is at least two to three generations behind Intel, Samsung and TSMC.

SMIC’s progress at 7nm and 5nm

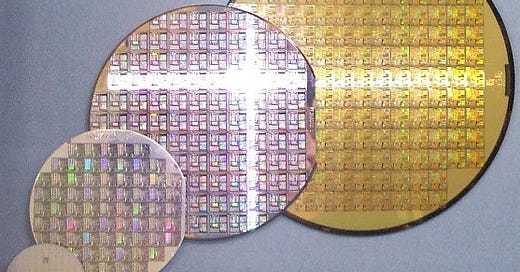

Founded in 2000, SMIC is China’s largest foundry vendor. Foundry vendors make chips for other companies in large facilities called fabs. Today, SMIC is the world’s third largest foundry vendor, behind TSMC and Samsung, according to TrendForce.

A large percentage of SMIC’s business involves manufacturing chips based on trailing-edge processes. But the Chinese company has been developing more advanced process technologies, and for good reason—China wants to design and manufacture more of its own chips, especially leading-edge devices. Plus, the nation needs leading-edge technologies to produce advanced AI chips.

In 2023, SMIC began manufacturing chips based on its new 7nm process. To date, this represents China’s most advanced logic technology. But China is still behind here. For example, TSMC introduced its 7nm process back in 2018.

In the fab, SMIC is manufacturing 7nm chips and other devices using various equipment. Lithography, one key equipment type, is used to help process chips in a fab. Basically, lithography systems pattern the tiny features in chips.

To make 7nm chips and other devices, SMIC is using less advanced lithography equipment, namely 193nm optical lithography systems with multiple patterning techniques. A 193nm wavelength lithography system utilizes deep ultraviolet (DUV) light to help pattern the tiny features in chips.

It would be easier to manufacture 7nm chips using extreme ultraviolet (EUV) lithography, a next-generation, 13.5nm wavelength system. But China is unable to obtain ASML’s EUV lithography scanners, due to export control regulations. So SMIC has no choice but to use less advanced lithography equipment.

Still, Huawei is using chips based on SMIC’s 7nm process. Huawei has incorporated HiSilicon’s 7nm SoC in its Mate 70 smartphone line as well as the Mate XT phone, the world's first tri-fold system.

Huawei is shipping these smartphones, but the shipment levels are limited by SMIC’s 7nm yields. “In terms of CY25 builds, shipments could still be supply limited by SMIC yields. Our supply chain checks suggest SMIC 7nm capacity is around 20K wspm and Huawei has procured ~15K wspm of this. Yields have improved to 60%-70% compared to <40% when initially launched in C2H23,” said Krish Sankar, an analyst at TD Cowen, in a research note.

For some time, SMIC has been working on a 5nm process. If the company could manufacture chips based on its 5nm technology, that would represent a major milestone in China. SMIC could close the gap in terms of logic technology with its foundry rivals, namely Intel, Samsung and TSMC.

But as stated, SMIC is unable to obtain ASML’s EUV scanners. So to make chips at the 5nm node, SMIC must still use less advanced 193nm optical lithography tools with multiple patterning.

That’s not a simple task. “Advanced logic nodes are made in China by using multiple patterning DUV instead of EUV photolithography. As a result, wafer yields and fab cycle times will suffer,” said Sam Wang, principal of Sam Wang’s Research, a consulting firm. “With certain assumptions, the achievable wafer yields estimated on Huawei’s three logic chips—a mobile processor as well as one medium and one large AI accelerator—are ranging from 46% to 25% for the 7nm-class process and 36% to 15% for the 5nm-class process.”

Not surprisingly, SMIC is struggling to develop its 5nm process. “SMIC's ‘5.5nm’ node is believed to still be in a pilot test line with yields below 20%,” TD Cowen’s Sankar said. The analyst said that SMIC’s technology resembles a 5.5nm process. Some believe that SMIC will try to put the 5nm-like technology into production in 2026.

Nonetheless, SMIC is losing ground in the technology race. The company is stuck at 7nm. Yet, Intel, Samsung and TSMC plan to ramp up their 2nm processes in the second half of 2025.

That still won’t stop China from competing in the marketplace. China is developing its own EUV systems, but it’s unlikely those tools will be ready for production in the near term. They may never appear.

“AI chips have become the focal point for China’s race with the USA. Huawei will try even harder to produce AI chips or chiplets by DUV photolithography in wafer manufacturing, either by multiple patterning or self-aligned patterning,” Wang said.

Conclusion

Nonetheless, China has made amazing progress in the semiconductor industry over the years. For example, China has a viable domestic foundry industry. China’s YMTC has made amazing progress with its 3D NAND technology. China-based companies are also competitive in the power semiconductor market, including silicon carbide (SiC) and gallium nitride (GaN) devices. And China is also making progress in advanced packaging.

In R&D, China is exploring several next-generation transistor technologies, such as gate-all-around (GAA) devices, 2D chips, carbon nanotubes and others. In other words, don’t underestimate China’s efforts in the semiconductor industry.