Changes Seen In Foundry Rankings

TSMC gained share in Q4 ‘24, but many other vendors lost ground

By Mark LaPedus

In the latest foundry rankings, TSMC gained share, but Samsung and several other vendors lost ground, according to a new report from TrendForce, a market research firm.

The foundry industry, a key part of the semiconductor business, involves a number of companies called foundry vendors. These vendors make chips for other companies in large manufacturing facilities called fabs.

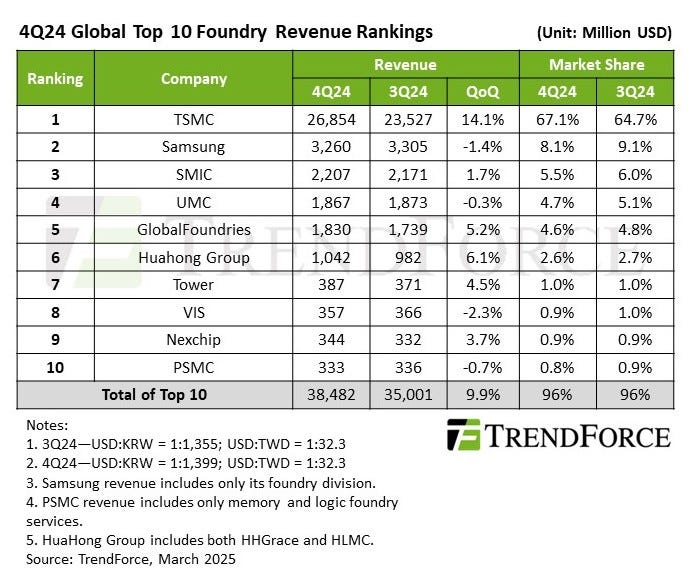

Taiwan’s TSMC, the world’s largest foundry vendor, reported sales of $26.85 billion in the fourth quarter of 2024. During this period, TSMC remained in first place in the foundry rankings with a dominate 67.1% market share, up from 64.7% from the third quarter of 2024, according to TrendForce (See rankings chart below).

TSMC benefited from robust demand from its AI foundry customers, namely Nvidia and AMD, during the fourth quarter of 2024. And in a recent move, TSMC plans to expand its investment in advanced semiconductor manufacturing in the United States by an additional $100 billion.

South Korea’s Samsung Foundry, the world’s second largest foundry vendor, reported sales of $3.26 billion in the fourth quarter of 2024, down 1.4% quarter-over-quarter, according to TrendForce. In the fourth quarter of 2024, Samsung Foundry had 8.1% market share, down from 9.1% from the third quarter of last year, according to TrendForce.

Samsung’s foundry division is undergoing a management review amid losses and lackluster yields for its 3nm gate-all-around (GAA) technology, according to a report from The Korea Economic Daily.

In recent times, Samsung has delayed its U.S.-based fab expansion project in Taylor, Texas by two years to 2026, according to the report. In addition, the company’s foundry business posted more than $1.4 billion in operating losses in the fourth quarter of 2024, according to the report.

In the fourth quarter of 2024, SMIC was in third place in the foundry rankings with 5.5% share, followed in order by UMC (4.7%), GlobalFoundries (4.6%), HuaHong Group (2.6%), Tower (1%) and VIS (0.9%), according to TrendForce.

Among the top 10 foundries, Nexchip was the only company to shift rankings, moving up to ninth place. PSMC fell to tenth place.

In the fourth quarter of 2024, the top 10 foundries achieve nearly 10% quarter-over-quarter revenue growth, reaching $38.48 billion, and marking an industry record, according to the research firm.

In 2024, the semiconductor industry was the tale of two markets. On one hand, Nvidia and a few others, which participate in various high-end AI chip segments, saw huge demand in 2024. On the other hand, the non-AI chip segments, such as automotive, consumer and industrial, experienced lackluster growth. As reported, 2025 appears to be following the same trend.