Fearless Chip & System Forecasts For 2025

What’s the outlook for semiconductors in 2025? And what are the big growth drivers?

By Mark LaPedus

Following a downturn in 2023, the worldwide semiconductor industry rebounded and experienced double-digit growth in 2024, mainly driven by robust demand in one market—AI.

So, what’s the outlook for the semiconductor industry in 2025? Like 2024, AI will continue to be a major growth driver this year. But in 2025, the worldwide semiconductor industry faces slower growth with several unknowns looming on the horizon.

Based on recent forecasts among several research firms, the worldwide semiconductor industry is projected to grow anywhere from 6% to 15% in 2025 as compared to 2024. The consensus is around 11% growth for 2025. These wide-ranging forecasts are not set in stone and could change throughout the year. Any number of factors could alter a given forecast, including changes in market conditions as well as the chip supply/demand picture.

Nonetheless, the current forecasts for 2025 are lower than the projected growth figures for 2024. Thanks to the booming AI market, the worldwide semiconductor industry is projected to reach $627 billion in 2024, up 19% over 2023, according to the World Semiconductor Trade Statistics (WSTS) organization.

In many respects, though, 2025 could resemble 2024. In 2024, the semiconductor industry was the tale of two markets. On one hand, Nvidia and a few others, which participate in various high-end AI chip segments, saw huge demand in 2024. Fueled primarily by the AI server market, Nvidia and a few others drove most, if not all, of the growth in the overall semiconductor industry in 2024. On the other hand, the non-AI chip segments, such as automotive, consumer and industrial, experienced lackluster growth.

2025 could follow many of the same patterns. Nvidia and a few others in the AI chip space are expected to see robust demand in 2025. However, some predict that the momentum for AI could slightly decelerate in the second half of this year. Meanwhile, vendors that participate in the non-AI chip segments are crossing their fingers, hoping for an upturn in the second half of 2025, if not sooner.

Geopolitical issues, trade policies and other factors could also impact the market in 2025. For example, in the United States, the incoming Trump administration has proposed to raise import tariffs for select nations, a move that could cause price hikes for PCs, smartphones, and video game consoles for U.S. consumers, according to the Consumer Technology Association (CTA). For now, though, it’s still unclear how the anticipated tariffs will impact the market.

To be sure, the semiconductor market is a complex industry with a multitude of dynamics. To help the industry gain some insights here, Semiecosystem has provided an outlook for the semiconductor industry in 2025. We will also examine various key markets, including automotive, PCs and smartphones as well as the AI chip segment, memory, foundry and packaging.

AI PCs, phones, cars

Before sizing up the 2025 market, it’s important to take a look back and examine how the semiconductor business has evolved in recent times. In 2023, the worldwide semiconductor market experienced a downturn, due to lackluster chip demand, bloated inventories and other factors. In terms of sales, the semiconductor market reached $526.9 billion, down 8.2% over 2022, according to the WSTS.

2024 was supposed to be a robust recovery year for the industry. Last year, the industry was banking on several new growth drivers to fuel the semiconductor business, including a new class of AI-enabled PCs, smartphones and servers. In addition, car makers expected robust demand for a new wave of electric vehicles (EVs).

As it turned out, 2024 was indeed a recovery year. Demand was enormous for AI servers, which in turn fueled the growth for Nvidia and a few others in the AI chip market. But not all of the anticipated growth drivers took off.

Last year, several vendors introduced a new class of AI PCs, which were (and still are) designed to elevate the productivity and entertainment features of a system. Featuring new processors and software, these systems are supposed to speed up the ability to use generative AI (GenAI), a type of AI that can create new content and ideas.

So far, though, consumers have not been impressed. And the AI PC market hasn’t taken off in any meaningful way. “There seems to be a big disconnect between supply and demand as PC and platform makers are gearing up for AI PCs and tablets to be the next big thing, but the lack of clear use cases and a bump in average selling prices has buyers questioning the utility,” said Jitesh Ubrani, research manager at IDC.

In 2024, the worldwide PC market is expected to grow by 3.8%, reaching 403.5 million units, according to IDC. In 2025, the PC market is expected to grow by 4.3%, according to IDC. This year, the growth driver for PCs isn’t AI, but rather by commercial upgrades from Windows 10 to Windows 11.

Like AI PCs, AI-based smartphones are supposed to elevate a user’s experience with GenAI. So far, consumers are less than enthusiastic about these products. "While GenAI continues to be a hot topic and a top priority for many vendors, it is yet to impact demand significantly and drive early upgrades," said Nabila Popal, senior research director at IDC.

In 2024, worldwide smartphone shipments are forecast to grow by 6.2% year-over-year to 1.24 billion units, according to IDC. In 2025, the growth is expected to be in the low single-digit range, according to the firm.

Unlike AI-enabled PCs and phones, demand for AI-based servers was enormous in 2024. Servers are large computers, which are found in businesses and data centers. The server market can be split into various segments, including general purpose and AI. General-purpose servers are used to process databases, e-mail and other traditional programs.

Today, AI servers make up about 15% the overall server business, according to TrendForce. AI servers are found in large data centers from the likes of Amazon, Google, Meta and Microsoft. These data centers incorporate a multitude of AI servers, which process the latest AI algorithms like GenAI and other programs.

AI servers incorporate the latest GPU chips from AMD, Nvidia and others. GPUs are ideal for processing AI algorithms. Typically, a GPU architecture incorporates an individual GPU device, along with high bandwidth memory (HBM), in a so-called 2.5D package.

There are other options besides GPUs for AI servers. Amazon and Google design their own, in-house AI chips. These devices are incorporated in AI servers within their own data centers.

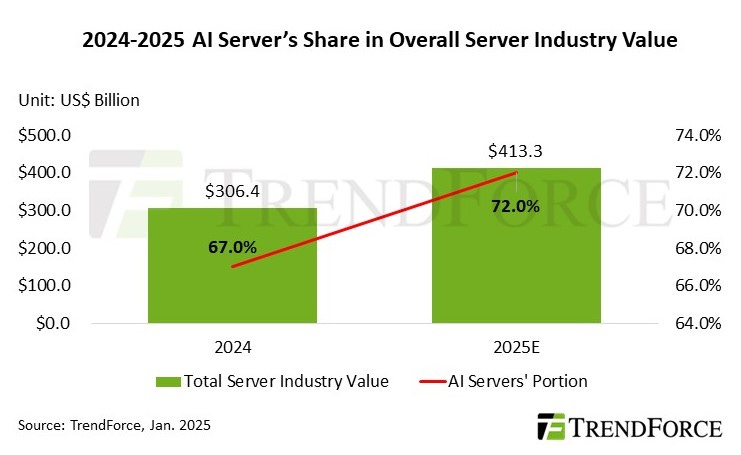

Nonetheless, the value of the entire server industry is estimated to total $306 billion in 2024, according to TrendForce. Within this total, the industry value specifically related to AI servers is estimated to be around $205 billion, according to TrendForce.

AI sever shipments are growing faster than the overall server market. In total, AI server shipments increased by 46% in 2024 over 2023, according to the research firm. The AI server market could cool off, at least to some degree. In 2025, TrendForce forecasts that AI server shipments will register a year-over-year growth rate of nearly 28%. The value of the AI server segment is expected to rise to $298 billion in 2025, they added.

Nonetheless, thanks to AI server demand, AMD and Nvidia saw enormous demand for their respective GPU device lines in 2024. And suppliers of HBM, namely Micron and SK Hynix, were sold out of these products last year. Samsung struggled in the HBM market.

AI servers are forecasted to account for over 70% of the total value of the entire server industry in 2025, up from 67% in 2024. Source: TrendForce

In contrast, the non-AI chip markets, including automotive, consumer and industrial, were in the doldrums in 2024. “Excluding the memory companies, the remainder of the semiconductor market was up only 6.8% (in 2024),” said Bill Jewell, president of Semiconductor Intelligence, in a research note. “If both the memory companies and Nvidia are excluded, the rest of the semiconductor market declined 10.5%.”

It's been a difficult period for the non-AI chip markets, particularly automotive, which always seems to be in the state of flux. In late 2024, for example, Nissan and Honda entered into merger negotiations. Mitsubishi is expected to join the merger talks. Consolidation in the industry translates into fewer customers for automotive chip suppliers.

Then, in total, new vehicle sales in 2025 are expected to grow by only 1.7% year-over-year to 89.6 million units, according to S&P Global Mobility. In 2024, new vehicle sales also grew by a mere 1.7% over 2023, according to S&P Global Mobility.

The lackluster forecast for 2025 is attributed to several factors, including tariff impacts, high interest rates, affordability challenges and energy price concerns, according to the firm.

On the bright side, the battery electric vehicle (BEV) market is growing faster than the overall car business. S&P Global Mobility projects global sales for BEVs to post 15.1 million units for 2025, up 30% over 2024, accounting for an estimated 16.7% of global light vehicle sales. In comparison, 2024 posted an estimated 11.6 million BEVs globally, for 13.2% market share, according to the firm.

Consumers in China and a few other nations have embraced EVs. But in the U.S. and elsewhere, EV sales are disappointing. As a result, most car makers have scaled back their ambitious EV plans.

Besides cars, computers and phones, there are other growth drivers for semiconductor suppliers, including AR/VR, defense/aerospace, medical electronics, MEMS, power electronics, silicon photonics and WiFi. Some of these markets are relatively large, such as defense/aerospace, power electronics and WiFi. Others are small but emerging segments like AR/VR and silicon photonics. But all of these markets don’t move the needle like the smartphone and PC businesses.

2025 chip forecasts

All told, 2025 appears to be a mixed picture for automotive, PCs and smartphones. AI servers remain a bright spot.

So what does this all mean for the semiconductor industry in 2025? 2025 is expected to be a growth year. But look for slower growth as compared to last year. In fact, the WSTS recently lowered its growth forecast for the overall semiconductor market in 2025. Originally, the WSTS projected 12.5% growth. In a revised forecast, the group projected that semiconductor sales will reach $697 billion in 2025, up 11.2% over 2024.

The WSTS also lowered its forecast for the memory market from 25.2% to 13.4% growth in 2025. But it raised its forecast for logic from 10.4% to 16.8% growth in 2025. The analog market is projected to grow by 4.7%, according to the WSTS.

Here are some other semiconductor growth forecasts for 2025:

*IDC—15%

*Gartner—13.8%

*Semiecosystem—10%

*Semiconductor Intelligence-6%

“Our Semiconductor Intelligence forecast of 6% growth in the semiconductor market in 2025 assumes some strengthening of core markets of PCs, smartphones, automotive and industrial. The rapid growth rates of memory and AI in 2024 should be significantly lower in 2025,” Semiconductor Intelligence’s Jewell said.

AI chip, memory forecasts

Indeed, the questions are clear: How long will the AI chip boom last? And will AI experience a slowdown sometime in 2025?

AI chips include custom accelerators, GPUs and HBM. Some experts say that the AI chip boom will last throughout 2025. Still others see a pause in demand, possibly in the second half of the year. “AI investments will remain a key growth driver, though data center capex growth in 2025 is expected to moderate as some hyperscale cloud service providers temporarily pause their expansion efforts,” according to the Dell’Oro Group.

Today, Nvidia, the big player in the AI chip market, continues to see enormous demand with no end in sight. In 2024, Nvidia experienced huge demand for its previous-generation GPUs. After some delays, the company shipped its next-generation GPU line late last year. Nvidia’s new GPU line, dubbed Blackwell, is built using TSMC’s 4nm process. Nvidia’s GPU architecture incorporates 8 HBM devices.

“Due to supply constraints, Blackwell demand is expected to exceed supply for several quarters in FY26,” said John Vinh, an analyst with KeyBanc, in a research note.

Other GPU suppliers are seeing similar demand. In total, GPU revenues are projected to total $51 billion in 2025, up 27% over 2024, according to Gartner. Thanks to Nvidia and others, HBM is sold out throughout 2025. In total, HBM revenues are expected to increase by more than 284% in 2024 and 70% in 2025, reaching $12.3 billion and $21 billion, respectively, according to Gartner.

HBM is a specialized product line, which is considered part of the overall DRAM market. DRAMs are chips that are used for the main memory functions in PCs, smartphones and other products.

Suppliers of HBM, namely Micron, SK Hynix, and Samsung, see enormous demand in 2025. But the same suppliers face lackluster demand for traditional DRAMs this year, due to sluggish growth for PCs and phones.

Today, HBM represents only a small part of the overall DRAM business. HBM will account for only 10% of the total DRAM bit output in 2025, doubling its share in 2024, according to TrendForce.

In other words, the booming HBM market won’t offset lackluster growth rates seen for the traditional DRAM market in 2025. “We expect industry DRAM bit demand growth to be in the high-teens percentage range in calendar 2024 and in the mid-teens percentage range in calendar 2025. We see overall calendar 2025 DRAM industry bit supply growing roughly in line with bit demand, with tightness in leading-edge nodes driven by the HBM supply ramp in the industry,” said Sanjay Mehrotra, president and chief executive of Micron, in a recent conference call.

It’s a different story for NAND flash memory, which is used for storage in systems. NAND flash memory is in a period of oversupply, causing suppliers to reduce their production of these chips in early 2025.

“Our outlook for industry NAND bit demand growth in both calendar 2024 and 2025 is now in the low double-digits percentage range, which is lower than our prior expectations,” Mehrotra said.

Foundry, packaging outlook

2025 is also expected to be a mixed bag for the foundry and IC-packaging businesses. Basically, the foundry business consists of a number of foundry vendors, which produces chips for other companies in large facilities called fabs. TSMC, Samsung, SMIC, UMC, GlobalFoundries and others compete in the foundry business (See chart below).

The foundry business reflects the current state of the semiconductor industry. In other words, foundry vendors with large exposure to the AI chip segment saw robust demand in 2024. Demand was lukewarm for the non-AI chip segments. In total, fueled by the AI market, the foundry business is projected to grow by 19.7% in 2024 over 2023, according to IDC.

The same dynamics will likely play out in 2025. In 2025, the foundry market is projected to grow by another 19.8%, according to IDC.

Foundry vendors manufacture chips using various process technologies. These processes can be divided into two segments—advanced and mature. Foundries use advanced processes to produce FPGAs, GPUs, processors and other complex chips. An advanced process involves the so-called 20nm node and below.

Mature processes are used to make a wide variety of chips, such as analog devices, CMOS image sensors, MEMS, power semiconductors and RF products. Mature processes involve the 22nm node and above.

Demand for advanced processes among foundry vendors was strong in 2024. The same is true for 2025. “Overall, wafer manufacturing is projected to increase by 7% annually in 2025, with advanced nodes capacity rising by 12% annually. Average capacity utilization rate is expected to remain above 90% and the AI-driven semiconductor boom will continue,” according to IDC.

Several foundry vendors are ramping new fabs for mature nodes. For some time, there has been an oversupply of processes at mature nodes in the foundry business. “In 2025, demand is expected to improve after (the 2024) correction and oversupply, driven by consumer electronics and sporadic inventory replenishment in the automotive and industrial control sectors. 8-inch fabs are expected to see their average capacity utilization rate climb to 75% from 70% in 2024, while 12-inch mature nodes will see their average capacity utilization rate rise to more than 76%,” according to IDC.

Meanwhile, in total, the packaging and testing business is expected to grow by 9% in 2025, according to IDC. Advanced packaging is expected to be a bright spot, growing by 19.2% in 2025, according to TechInsights.

Today, several advanced packaging types are in high demand, particularly 2.5D. Nvidia and others rely on TSMC’s 2.5D packaging technology, dubbed Chip-on-Wafer-on-Substrate (CoWoS). For some time, TSMC has experienced greater than expected demand for CoWoS, creating capacity shortages for the technology.

To help meet demand, TSMC is expected to boost its CoWoS production capacity from 330,000 wafers in 2024 to 660,000 wafers in 2025, an annual increase of 100%, according to IDC.

(Send comments to: mdlapedus@gmail.com Semiecosystem reserves the right to post and edit comments.)