Imec Launches Automotive Chiplet Program

Arm, ASE, BMW, Bosch, Cadence, Siemens, Synopsys and Tenstorrent are part of the group.

By Mark LaPedus

Imec, a Belgium-based R&D organization, has launched an automotive chiplet program. The initiative could solve some major chip design challenges for car makers.

Imec’s initiative, called the Automotive Chiplet Program (ACP), includes car makers, EDA vendors, packaging houses and semiconductor companies. Arm, ASE, BMW Group, Bosch, Cadence Design Systems, Siemens, SiliconAuto, Synopsys, Tenstorrent and Valeo are the first companies that have committed to join Imec’s ACP.

The research will be done at Imec’s headquarters and its affiliated research groups like the University of Michigan. The goal of the program is to evaluate which chiplet architectures and packaging technologies are best suited to support the automotive industry.

Chiplets are becoming an important part of the semiconductor industry. For years, semiconductor companies have developed and shipped various high-performance chips. One such chip, a high-end processor, is used to handle the complex processing functions in systems. Generally, a processor may consist of multiple and complex functions all on the same device.

In some cases, the processor is a relatively large device. Large devices tend to be difficult and expensive to manufacture in a fab. At times, they suffer from lackluster yields.

One way to solve these problems is to embrace the chiplets concept. In chiplets, the idea is to break up a large device into smaller dies. Smaller die sizes are easier to manufacture. They tend to have better yields with lower costs.

Once the chiplets are fabricated, they are assembled in an advanced package. A package is a product that encapsulates a chip, protecting it from harsh operating conditions.

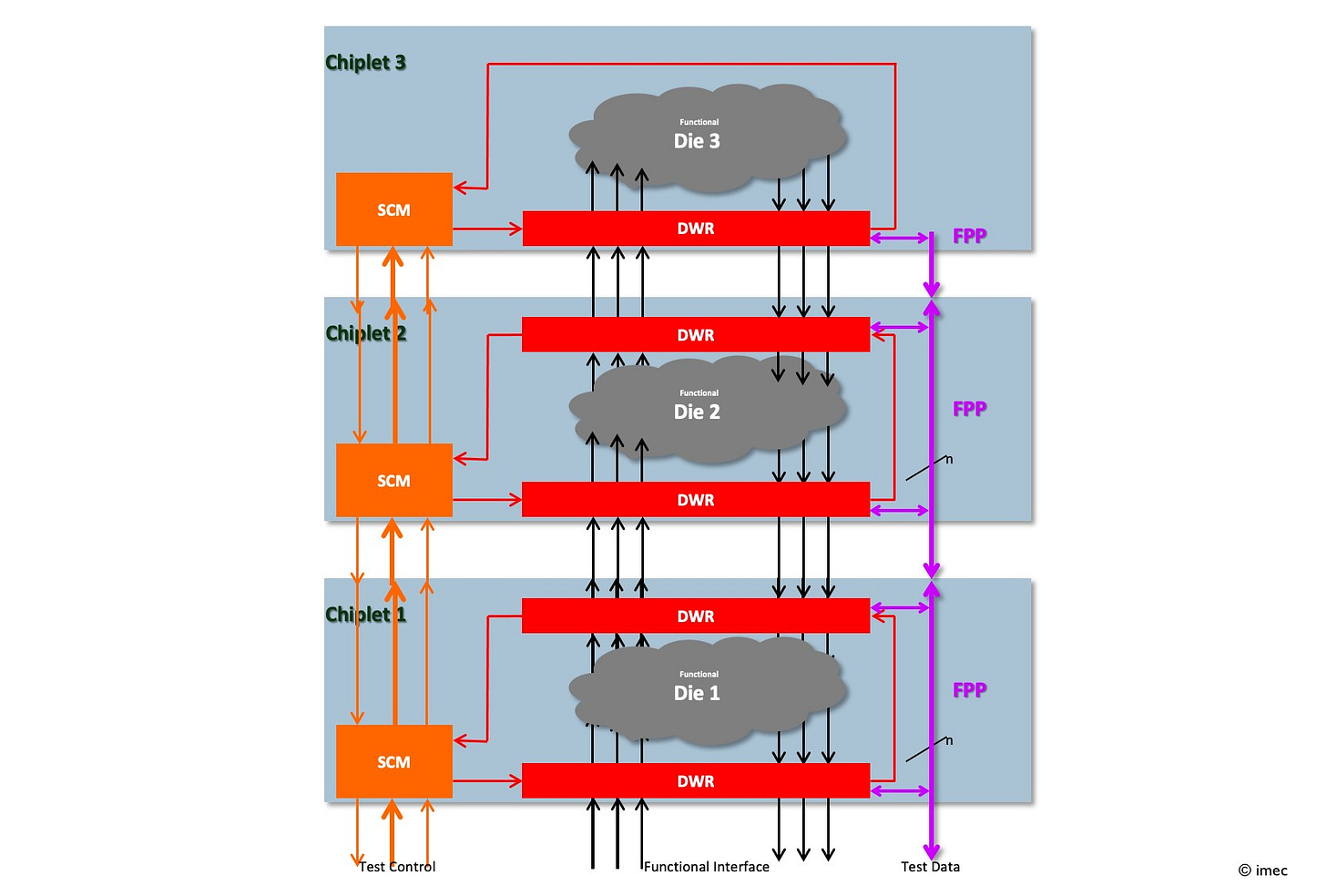

Cross-section of a 3D stack with three chiplets. IEEE Std 1838 introduced design-for-test elements in the various chiplets to form ‘‘elevators’’ that allow the test stimuli and their responses to reach every chiplet in the stack. Source: Imec

High-end computer and smartphone vendors tend to embrace the chiplet concept. AMD, Apple, Intel, Nvidia and others have developed various chip architectures using the chiplet concept.

But the risk-adverse automotive industry has been reluctant to embrace the chiplet paradigm. Generally, a car may incorporate from 1,000 to 3,000 chips. Electric vehicles incorporate even more chips.

Car makers cannot afford to have any chip failures in the field. So, each chip in a vehicle must meet strict reliability requirements. Car makers have zero defect policies for their chip suppliers.

Thus, car makers tend to be conservative when it comes to the chip designs in a given vehicle. Many of the chips used in automotive systems are older devices based on more mature processes. These devices are proven and tend to be more reliable.

Generally, in many high-end vehicles, the chips are more complex in some parts of the vehicle. Chips for advanced driver assistance systems (ADAS) are one example. These chips are used for several complex applications, such as pedestrian detection/avoidance, lane departure warning/correction, traffic sign recognition, automatic emergency braking, and blind spot detection.

In a more extreme example, Waymo, a self-driving car company, incorporates an onboard computer in a vehicle, which combines the latest server-grade CPUs and GPUs. It takes information provided by dozens of sensors on the car, identifies the different objects, and plans a safe route towards one’s destination – all in real time.

Lately, some traditional high-end chip architectures have struggled to meet the requirements of ever more demanding automotive applications.

That’s where chiplets fit in. These are modular chip architectures that are specifically designed to perform specialized functions. They can be combined to create sophisticated compute systems.

“The adoption of chiplet technology would signal a disruptive shift in central vehicle computer design, offering distinct advantages over traditional monolithic approaches. Chiplets facilitate rapid customization and upgrades, while reducing development time and costs,” explained Bart Placklé, vice president of automotive technologies at Imec. “However, moving to a chiplet architecture is prohibitively expensive for OEMs if done in isolation. Commercial viability thus hinges on industry alignment around a set of chiplet standards, enabling car manufacturers to procure chiplets from the market and integrate them with proprietary chiplets to build unique offerings.”

Imec’s new program is designed to help bring chiplets into the automotive space. “We are convinced that all stakeholders will gain important insights from the program’s pre-competitive, collaborative approach – leveraging the partners’ collective wisdom and means to make rapid progress,” Placklé said.

But there are challenges in developing a chiplet-based device. In chiplets, each die must be proven and reliable. Unwanted defects in a die could cause the entire chiplet-based product to fail.

Each die in the chiplet package must communicate with one another. Typically, for their respective chiplet-based designs, semiconductor vendors tend to use proprietary die-to-die communication protocols and interfaces. Larger semiconductor companies can afford to develop these technologies. Most vendors don’t have the resources.

More importantly, a chiplet architecture must withstand harsh operating conditions in a car. Needless to say, a chiplet cannot afford to fail in the field.