MEMS Market Heats Up With New Devices and Fabs

Silex Microsystems and Rogue Valley Microdevices are building new 300mm foundry MEMS fabs, while new foundry vendors emerge in China and Japan.

By Mark LaPedus

The MEMS business, a critical technology sector that often flies under the radar, is heating up on several fronts.

On one front, the MEMS business is poised for growth in 2024 following a downturn in 2023. On another front, several companies are rolling out the next wave of MEMS devices. And some vendors are building new manufacturing facilities, or fabs, that will produce MEMS, a group of critical components used in a multitude of systems.

MEMS, which stands for microelectromechanical systems, are tiny devices that integrate mechanical and electromechanical elements in the same unit. Typically, a MEMS device incorporates a moving part, which ranges in size from a micron to a millimeter, according to the Yole Group. A MEMS sensor, one type of MEMS device, converts physical values, such as velocity and temperature, into an electric signal, according to Yole.

MEMS devices involve a diverse range of products. Accelerometers, gyroscopes, microfluidic devices, microphones and pressure sensors are just some of the examples of MEMS devices. These devices are found in cars, computers, printers, medical equipment, smartphones, wearables and other products.

For example, today’s smartphones incorporate a multitude of chips and components, including a MEMS-based accelerometer and gyroscope. In simple terms, accelerometers and gyroscopes help detect the orientation of the phone, enabling it to autorotate during the movement of the system. In another typical application, a MEMS-based microphone is integrated in a system, enabling studio-quality audio in the product. In cars, a MEMS-based pressure sensor is used to monitor the inflation of each tire.

Those are just a few of the examples of MEMS devices in the market. Basically, in the production flow, a company will design a specific MEMS device. Then, the device is manufactured in a fab using various fabrication techniques. In some cases, the development cycle for a MEMS device is relatively long, due in part to the lack of established design and manufacturing practices.

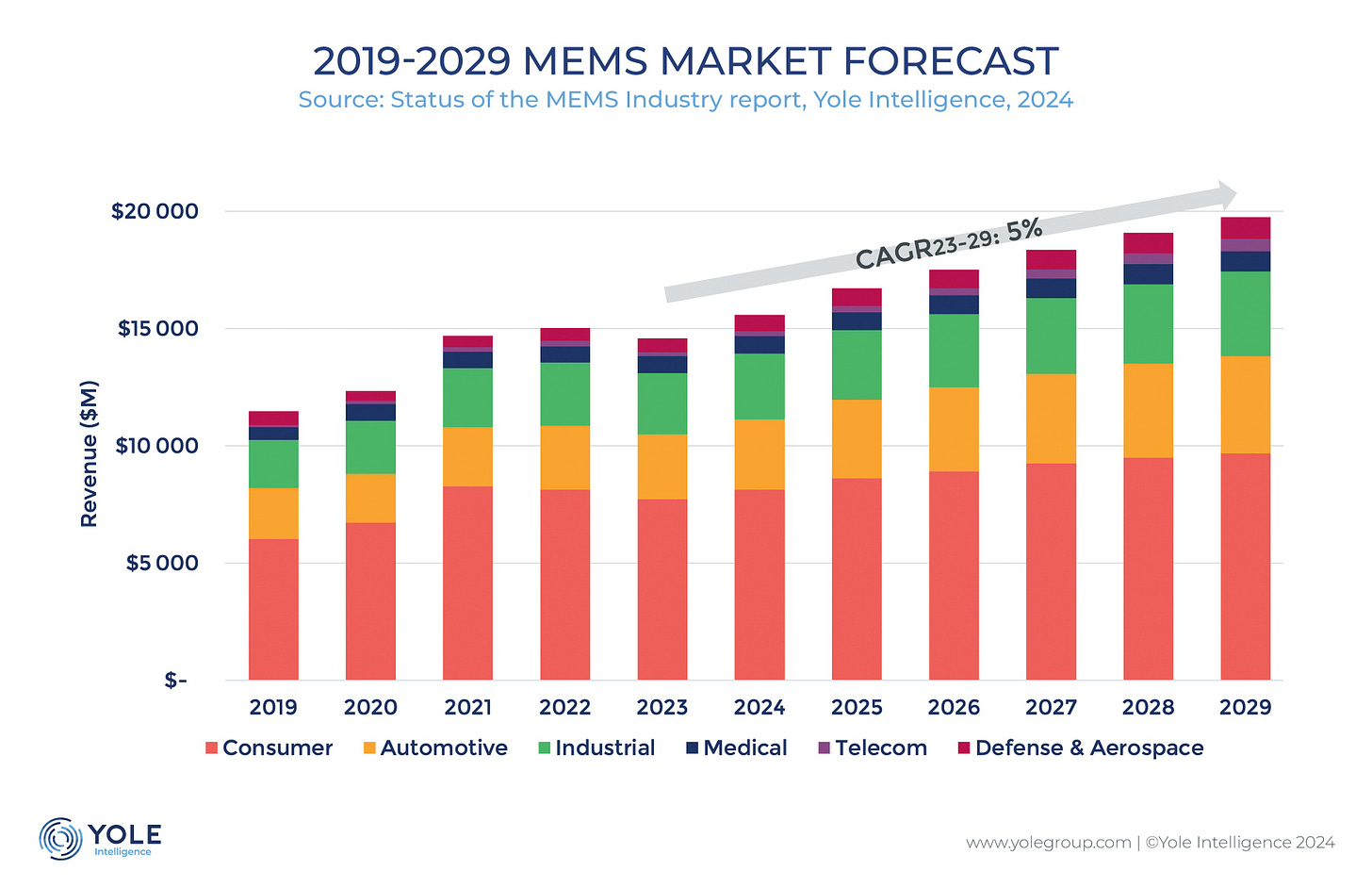

MEMS is also a cyclical business. After years of steady growth, the MEMS market experienced a downturn in 2023. “In 2023, the MEMS industry experienced a decline to US$14.6 billion (a 3% year-over-year decrease), primarily because of a downturn in consumer electronics and economic cycles,” said Pierre Delbos, an analyst at Yole. “Despite this challenging year, the MEMS market is expected to grow again in 2024. Approximately 34 billion units are projected to be shipped in 2024 (a 9% year-over-year increase), resulting in US$15.6 billion in revenue.”

Electric vehicles (EVs), true wireless stereo (TWS) earbuds/headphones and other products are expected to drive the demand for MEMS. But smartphones, the largest MEMS market, remains a sluggish business with flat growth.

Besides the upturn, there are other major events in MEMS, including:

*China’s Silex Microsystems, the world’s largest MEMS foundry vendor, is building a new 300mm fab. A foundry vendor is a company that makes chips and/or MEMS devices for other entities in large fabs.

*Rogue Valley Microdevices (RVM), a U.S.-based MEMS foundry, is building a new 300mm fab. To help build this fab, RVM has obtained funding from the CHIPS and Science Act, a U.S. government initiative to boost semiconductor production in the United States.

*Japan’s Sumitomo launched a new MEMS foundry venture.

*Several MEMS companies from China have emerged.

*Companies have introduced new MEMS devices.

The pioneers

In 1947, U.S.-based Bell Labs invented the transistor. One of the key building blocks in a semiconductor device, a transistor amplifies or switches electrical signals within a chip.

The integrated circuit (IC), which incorporates transistors and other components on the same device, was co-invented in 1958 and 1959. These breakthroughs eventually paved the way towards the development of new computers, smartphones and other electronic products. New chips also enabled countless innovations in the automotive, consumer and industrial sectors.

The MEMS industry emerged in 1965, when Harvey C. Nathanson invented the first MEMS device—a tuner for radios. The device was developed at Westinghouse Research Labs.

MEMS also played a big role in the industry. In 1979, HP devised a MEMS-based inkjet printhead for printers. In 1993, Analog Devices produced a high-volume and inexpensive accelerometer for airbags in cars, according to the Southwest Center for Microsystems Education.

The MEMS market took off in the 2000s, thanks to the smartphone. Accelerometers, gyroscopes and other devices became an integral part of the phone. An accelerometer measures linear acceleration of movement, while a gyroscope measures the angular rotational velocity, according to GSMArena.com.

[NIST’s MEMS-based rheometer. The moving plate is controlled by resistance heating elements in the chevron-like structure at the top; expansion and contraction of the vanes causes the plate to move up and down. Central square where the sample would rest is approximately 500 micrometers across. Credit: Christopher/NIST]

New MEMS devices

The MEMS ecosystem, meanwhile, is straightforward. Typically, MEMS suppliers design and develop a MEMS device. Some MEMS suppliers have their own fabs. These suppliers manufacture their devices within their own facilities.

Many MEMS suppliers are fabless. These suppliers use foundry vendors, which make devices for other companies in fabs.

In 2022, Bosch was the largest MEMS supplier in terms of sales, followed in order by Broadcom, Qualcomm, STMicroelectronics, Qorvo, TI, TDK, HP, Goermicro, and NXP, according to Yole.

The MEMS industry continues to develop new and innovative products. Earlier this year, for example, Bosch introduced the world's smallest MEMS accelerometers for use in wearables and hearables. Compared to Bosch's current generation accelerometers, the new devices have a 76% smaller footprint and have been reduced in height from 0.95mm to 0.55mm.

In a separate announcement, Bosch recently formed a partnership with Randox Laboratories and R-Biopharm. The goal is to develop a real-time PCR (polymerase chain reaction) test to detect sepsis, which is a condition where the body responds improperly to an infection.

The companies developed a new PCR test solution, which combines MEMS with a microfluidics chip. A microfluidics chip is a tiny device with small channels. Fluids are pumped into the device and then separated and analyzed. A microfluidics device is used to detect different diseases. This depends on the fluid injected in the device.

Bosch and its partners developed a novel BioMEMS chip, which is integrated inside a small cartridge. The cartridge is inserted into Bosch’s laboratory diagnostic platform for analysis.

“On the chip, we can test a sample for up to 250 genetic characteristics simultaneously and automatically by means of parallel real-time PCR analyses. This can be done in under 15 minutes and directly where the sample is taken,” said Daniel Podbiel, a research engineer at Bosch, on the company’s website.

Meanwhile, in April, Fortemedia launched a coil-based MEMS speaker line, enabling ultra high-definition sound in systems. Recently, Melexis introduced a next-generation MEMS pressure sensor, which handles gas and liquid media measurements. The device is targeted for EV thermal management systems.

MEMS manufacturing and foundries

MEMS devices are manufactured in fabs. In a MEMS fab, a vendor uses various equipment to produce a given MEMS device. Each device is unique and requires a specific fabrication process.

MEMS fabs utilize many of the same fabrication techniques used in today’s semiconductor fabs. But the fabrication of a MEMS device is sometimes different from traditional chip production. In some cases, MEMS will make use of non-standard materials and techniques in the fab.

As stated, many MEMS suppliers have their own fabs. These vendors include Bosch, NXP, Qorvo, STMicroelectronics, TI and others.

Fabless MEMS suppliers use foundry vendors for their manufacturing requirements. One company is bucking the trend. Menlo Microsystems, a U.S.-based fabless MEMS vendor, last year announced plans to build its own fab in New York state.

Today, there are many MEMS foundry vendors in the market. Based on Yole’s rankings in 2021, China’s Silex was the world’s largest MEMS foundry vendor, followed in order by Teledyne, TSMC, X-Fab, Sony, Atomica, Asia Pacific Microsystems, Vanguard, Philips, Tower, Bosch, UMC, STMicroelectronics, Rohm, Semefab and others.

Not all foundry vendors are alike. Each foundry offers a different manufacturing capability and a production process. Silex, for example, specializes in MEMS production. TSMC, the world’s largest silicon foundry vendor, is on the other end of the spectrum. TSMC is a broad-based foundry vendor, offering logic and specialty chip production as well as IC-packaging services.

Logic chips involve GPUs, processors and other devices. Specialty chips include analog devices, embedded memory, high-voltage ICs, image sensors, MEMS, RF products and others.

So, MEMS is only a small part of the overall foundry business. Still, the MEMS foundry business is a competitive market with a number of players in the arena.

Despite what appears to be an overcrowded market, several new MEMS foundry vendors have recently emerged. China, for one, is making several moves in the arena. For example, in 2015, a group from China acquired Silex.

Then, in 2018, SMIC, the Shaoxing Government and Shengyang Group formed a new China-based joint foundry venture called Semiconductor Manufacturing Electronics Corp. (SMEC). SMIC, China’s largest silicon foundry vendor, along with the other partners invested in SEMC. SEMC is a MEMS and power device foundry.

In 2023, SMEC changed its name to United Nova Technology. The company also obtained a new round of funding.

China’s Guangzhou Zengxin Technology, also known as Zensemi, recently emerged. Zensemi is building a MEMS fab. China also boasts several MEMS fabless design companies.

Others are also throwing their hats in the ring. In early 2024, Japan’s Sumitomo Precision Products launched a new MEMS foundry unit. This unit, called MEMS Infinity, owns and operates a 150mm and 200mm fab.

MEMS Infinity is capable of manufacturing various MEMS devices. The unit is also one of the few foundries offering a portfolio of lead zirconate titanate (PZT) thin films. PZT is a piezoelectric material used for MEMS sensors and other products. These products are ideal for various applications, such as AR/VR, automotive LiDAR, haptics, true wireless stereo and ultrasound imaging.

A.M. Fitzgerald & Associates, a MEMS product development company, and MEMS Infinity recently formed an alliance to expedite the commercialization of thin-film PZT materials for MEMS.

“As a material that enables many types of emerging, performance-intensive MEMS devices, thin-film PZT is much in demand,” said Alissa M. Fitzgerald, founder and chief executive of A.M. Fitzgerald. “PZT, however, requires specific process tools and expertise that are not widespread. For companies trying to develop PZT MEMS technologies, it’s been especially difficult to access commercial-quality material during development stages, while wafer volumes are low. That’s a problem because using poorly controlled research-grade materials during prototyping really slows down product development.”

300mm MEMS fabs

There are other major developments. Many vendors manufacture MEMS devices in 150mm and 200mm wafer fabs. Some are ramping up 300mm MEMS fabs. In fact, two MEMS foundry vendors, Silex and RVM, are building new 300mm MEMS fabs. Silex is building a 300mm fab in Järfälla, Sweden, while RVM’s facility is located in Palm Bay, Florida.

Silex’s new 300mm fab is situated near its 200mm facility. A 300mm fab enables Silex to increase its overall manufacturing capacity. It also enables the company to process more devices on each wafer, enabling it to lower its manufacturing costs.

Meanwhile, RVM’s new 300mm fab is expected to move into production in the first quarter of 2025. To help build its fab, RVM obtained up to $6.7 million in proposed funding under the CHIPS and Science Act. The CHIPS Act is designed to accelerate chip production in the U.S.

RVM is a MEMS foundry vendor that specializes in small-batch to low-volume MEMS production. This type of foundry is critical for various industries, such as aerospace/defense, medical and others.

To be sure, MEMS doesn’t get as much attention as the semiconductor industry. But MEMS are also important. Car companies, computer makers, smartphone vendors and other systems houses will always want, if not demand, the latest and greatest MEMS for their systems.