Micron To Invest $200 Billion in Fabs And R&D in U.S.

What are Micron’s fab plans in the United States? In addition, the company rolled out its first EUV-enabled DRAMs.

By Mark LaPedus

Micron Technology has announced its new and revised fab investment plans in the United States.

Under the plan, Micron will invest $200 billion in semiconductor manufacturing and R&D in the U.S., which represents a $150 billion increase from its original investment plans.

With the investments, Micron hopes to expand its memory chip production in the U.S. As part of those efforts, Micron plans to build a second memory fab in Idaho, modernize its existing fab in Virgina, and bring high bandwidth memory (HBM) manufacturing capabilities to the U.S. As previously announced, Micron’s investments include its ongoing plans to build a “megafab” complex in New York state.

These announcements represent a major boost for the U.S. semiconductor industry. Micron is the only U.S.-based manufacturer of advanced memory chips. The company produces 3D NAND, DRAMs and HBM. Micron owns and operates fabs in Japan, Singapore, Taiwan and the U.S.

But a large percentage of Micron’s overall memory production is located outside the U.S. In fact, the vast majority of all memory chips are produced outside the U.S. Currently, 100% of leading-edge DRAM production occurs overseas, primarily in East Asia.

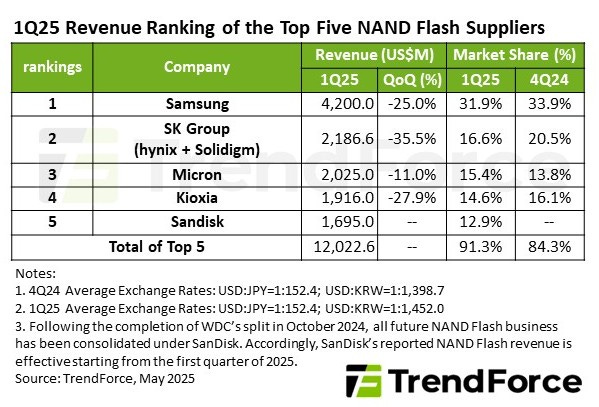

Besides Micron, Samsung, SK Hynix and others compete in the DRAM business. Kioxia, Micron, Samsung, SK Hynix, Sandisk and YMTC compete in the 3D NAND arena. (See market share charts below)

Meanwhile, the vast majority of leading-edge logic chips are still produced by TSMC in Taiwan. Plus, Asia-based companies produce a large percentage of the world’s trailing-edge logic chips. Trailing-edge chips are important. Nearly every electronic system, such as appliances, cars, consumer products, industrial systems and smartphones, use these types of chips.

Changes in the CHIPS Act

It’s a complex situation. For years, the U.S. has been the leader in designing new chips in the market. But U.S.’s worldwide share of chip-manufacturing capacity has declined at an alarming rate over the years.

In fact, the U.S. is dependent on Asia and other regions for the production of a large percentage of its chips. That’s problematic for U.S. national security as well as the nation’s competitiveness and the supply chain.

In response, under the previous Biden administration, the U.S. government in 2022 launched a new program called the CHIPS and Science Act, which was supposed to jumpstart chip manufacturing in the U.S.

Intel, TSMC and a few others obtained grants from the CHIPS Act. Many other entities were awarded various projects under the Biden administration. But most of those entities have yet to obtain any funding.

Then, earlier this year, the Trump administration took control of the CHIPS and Science Act. The Trump administration set up a new office that will revamp and administer the CHIPS Act.

At present, the administration is reviewing the projects from the CHIPS Act that were awarded under the Biden administration. Some projects have received the green light to proceed by the Trump administration. But in order to proceed, the administration wants chip companies to increase their original investments in the U.S.

For example, in March, TSMC announced its intention to expand its investments in advanced semiconductor manufacturing in the U.S. by an additional $100 billion. The expansion includes plans for three new fabrication plants, two advanced packaging facilities and an R&D center. TSMC’s total investment in the U.S. is expected to reach $165 billion.

Then, in May, Taiwan’s GlobalWafers, a supplier of silicon wafers, announced plans to increase its investments in the U.S. by another $4 billion. In total, the company plans to invest $7.5 billion in the U.S.

In June, GlobalFoundries (GF) announced plans to invest $16 billion to expand its semiconductor manufacturing and advanced packaging capabilities in the U.S.

What about Micron?

Last year, Micron Technology obtained CHIPS funding under the previous Biden-Harris administration. At the time, Micron was awarded $6.165 billion in direct funding under the CHIPS Act.

The grants would support Micron’s plans to invest approximately $50 billion in capital spending through 2030. The investments would also help fund a trio of fab projects, including:

*A “megafab” complex in Clay, N.Y. Micron recently announced plans to build a megafab complex in New York state. That involves four fabs, which would produce DRAMs.

*A new DRAM fab in Idaho. Micron also announced plans to build a new production fab for DRAMs in Boise.

*Micron was also in line to obtain $275 million in proposed funding to expand and modernize its existing fab in Manassas, Va.

Fast forward. Now, under the auspices of the Trump administration, Micron plans to expand its U.S. investments to approximately $150 billion in domestic memory manufacturing and $50 billion in R&D. The total investment is $200 billion.

So what’s new here? Here’s where the funding is going:

*As part of the new announcement, Micron plans to build a second memory fab in Boise. The first Idaho fab, which was previously announced, is scheduled to begin production in 2027. That fab will produce DRAMs.

*Following the completion of the second Idaho fab, Micron plans to bring HBM packaging capabilities to the U.S. Micron didn’t provide any timetable for the second Idaho fab or the HBM facility.

*The company, however, expects that its second Idaho fab to come online before the first New York fab. Micron still plans to build up to four leading-edge production fabs in New York state. No timetable was given for those fabs.

*Additionally, Micron has finalized a $275 million CHIPS Act direct funding award supporting its investment to expand and modernize its Manassas, Va facility, which will begin this year. This investment will onshore Micron’s 1-alpha DRAM node.

Micron anticipates that all of its U.S. investments will be eligible for the Advanced Manufacturing Investment Credit (AMIC), and the company has already secured support at the local, state and federal level. This includes up to $6.4 billion in CHIPS Act direct funding to support the construction of two Idaho fabs and two New York fabs, as well as the expansion and modernization of its Virginia fab.

Micron’s 1γ (1-gamma) DRAM with EUV

Separately, Micron Technology is shipping qualification samples of the world’s first 1γ (1-gamma) node-based low-power double data rate 5X (LPDDR5X) DRAM, designed to accelerate AI applications on flagship smartphones. Delivering the industry’s fastest LPDDR5X speed grade of 10.7 gigabits per second (Gbps), combined with up to a 20% power savings, Micron LPDDR5X DRAM transforms smartphones with faster, smoother mobile experiences and longer battery life — even when executing data-intensive workloads such as AI-powered translation or image generation.

To meet the industry’s increasing demand for compact solutions for next-generation smartphone designs, Micron has shrunk the LPDDR5X package size to offer the industry’s thinnest package of 0.61 millimeters, making it 6% thinner compared to competitive offerings, and representing a 14% height reduction from the previous generation.

Micron’s 1γ-based LPDDR5X DRAM is the company’s first mobile solution to leverage EUV lithography. Micron is currently sampling 1γ-based LPDDR5X 16 gigabyte (GB) products to select partners and will offer a wide range of capacities from 8GB to 32GB for use in 2026 flagship smartphones.