Samsung Reshuffles Chip Execs Amid Setbacks

Samsung has announced a major reorganization within its foundry and memory businesses.

By Mark LaPedus

Samsung has announced a major reorganization within its foundry and memory businesses amid a series of setbacks in the arena.

Young Hyun Jun, vice chairman and head of Samsung’s Device Solutions (DS) division, has been name co-chief executive as well as the head of the company’s memory business and the Samsung Advanced Institute of Technology. He replaces Jung-Bae Lee, the previous head of Samsung’s memory business, according to a report from The Korea Times.

Jinman Han was promoted to president and will become the head of the company’s foundry business, replacing Choi Si-young, according to the report. Han was previously executive vice president of Samsung and president of the company’s semiconductor business in the U.S.

Seok Woo Nam, previously president and head of fab engineering and operations for Samsung, has been named chief technology officer of the company’s foundry business, a newly-created position.

JH Han, vice chairman, co-CEO and head of the Device eXperience (DX) division, will also lead a newly-created committee that will focus on strengthening product quality across the company.

The changes follow a series of setbacks at Samsung, a large, diversified supplier of displays, semiconductors, smartphones and other products. In the semiconductor sector, the company competes in the CMOS image sensor, foundry, memory, among other chip businesses.

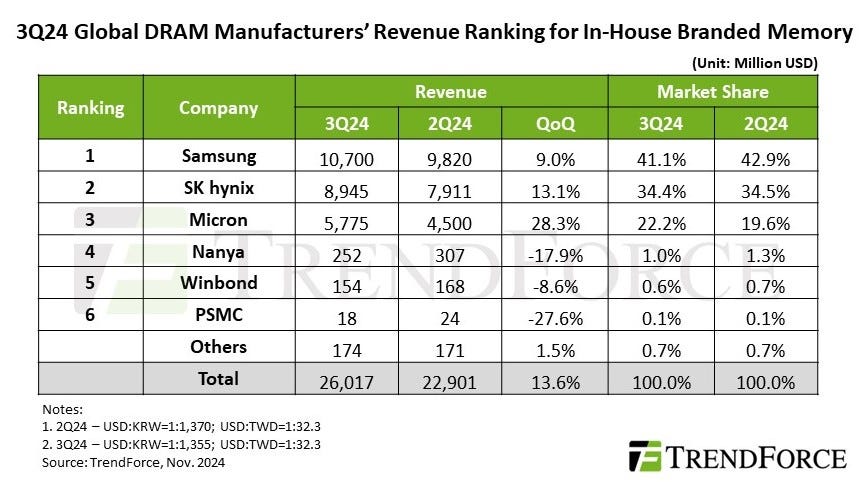

For years, the company has been the leader in the DRAM and NAND flash memory businesses in terms of market share (See below for DRAM market share chart). But the company has struggled in a growing part of the business--high-bandwidth memory (HBM). HBM is a specialized memory device used in high-end systems, such as servers.

To make an HBM device, a DRAM supplier takes a standard DRAM chip, and vertically stacks 4 to 12 of these memory chips on top of each other. The DRAM dies are connected using tiny vertical wires called through-silicon vias (TSVs). The TSVs provide the electrical connections between each die.

HBM is often found in high-end chip architectures as a means to boost the memory bandwidth in systems. Take Nvidia’s AI chip architectures for example. Nvidia combines its GPU chips with several HBMs in a 2.5D package.

Nvidia doesn’t make HBMs. Instead, the company sources its HBMs from two suppliers—Micron and SK Hynix. Both Micron and SK Hynix have been qualified by Nvidia to support the company’s previous-generation AI chip line, dubbed the H200.

For some time, Samsung’s HBMs have struggled to meet spec for this AI device. According to reports, Samsung was only recently qualified by Nvidia for the H200.

Now, Micron and SK Hynix have been qualified to support Nvidia’s latest AI chip line, dubbed Blackwell. Samsung has yet to pass the qualification process for Blackwell, analysts said.

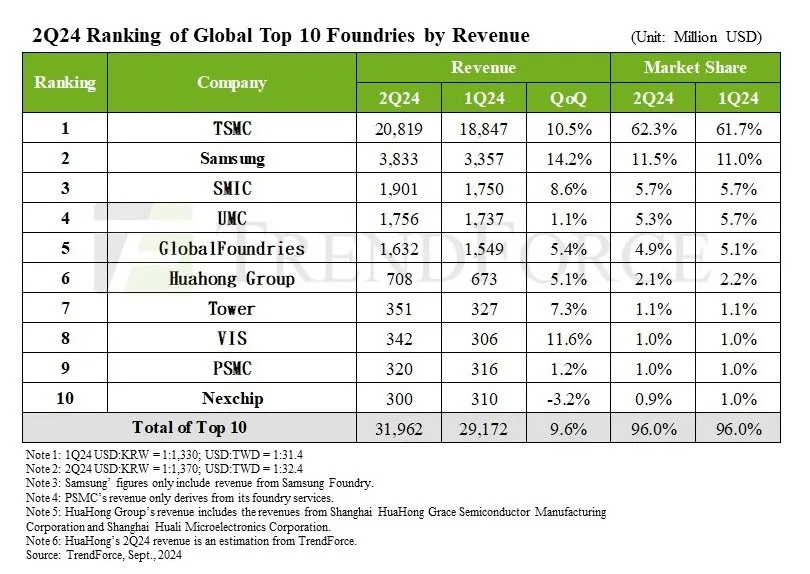

At the same time, Samsung has been struggling in the foundry business, especially at the leading edge. Foundry vendors make chips for other companies in large manufacturing facilities called fabs (See below for foundry market share chart).

In the leading-edge foundry business, Samsung released its 3nm process in 2022, which represents the company’s most advanced technology. A process is a term used in the semiconductor industry that describes the design rules and recipes used in manufacturing a given chip line.

Samsung’s 3nm process makes use of a next-generation transistor technology called gate-all-around (GAA). But Samsung has been beset with yield issues with its leading-edge processes.

Samsung recently posted sales of 79.1 trillion won ($57.4 billion) in the third quarter of 2024, up 7% from the previous quarter and up 17% year-over-year. Operating profit was 9.18 trillion won ($6.7 billion) for the quarter, down by 1.3% from the previous quarter but up 6.8% year-over-year.

Samsung continues to lead the DRAM market, but SK Hynix is gaining ground. Source: TrendForce

TSMC dominates the foundry landscape. Others are fighting for second and third place. Source: TrendForce