Shakeup Seen In Foundry Rankings

China’s SMIC moves up in the ranks, while Intel, Samsung and others fight for share.

By Mark LaPedus

There is a major shakeup in the rankings within the competitive semiconductor foundry business.

In the most recent rankings, SMIC, China’s largest foundry vendor, moved up in ranks, leapfrogging over two rivals in the business. Other vendors are also jockeying for position in the foundry business, which is an important part of the semiconductor industry.

Foundry vendors make chips for other companies in large manufacturing facilities called fabs. For years, Taiwan’s TSMC has been the dominant player in the foundry business. Intel, Samsung and other companies also participate in this large and competitive market. In any case, the rankings are based on a foundry vendor’s worldwide sales, or market share, during a given period. The rankings also provide a snapshot of the foundry landscape.

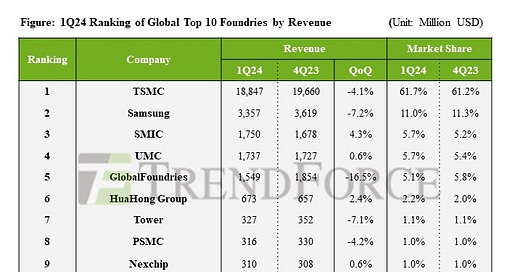

The foundry business is changing. For example, in the fourth quarter of 2023, TSMC was in first place in the foundry rankings with 61.2% share of the market, according to TrendForce. In the same period, Korea’s Samsung was distant second (11.3%), followed in order by GlobalFoundries (5.8%), UMC (5.4%), SMIC (5.2%), Huahong Group (2%), Tower (1.1%), Powerchip (1%), Nexchip (1%) and Vanguard (1%), according to the research firm.

In TrendForce’s latest rankings, which involves the first quarter of 2024, TSMC is still in first place with 61.7% share, followed by Samsung with 11%.

From there, the rankings have changed. SMIC jumped from fifth to third place with 5.7% share in the first quarter of 2024, leapfrogging U.S.-based GlobalFoundries (GF) and Taiwan’s UMC, according to TrendForce.

UMC (5.7% share) remains in fourth, while GF (5.1%) fell from third to fifth. SMIC and UMC had the same share, but SMIC’s sales were slightly higher in the first quarter of 2024. Huahong (2.2%) remains in sixth, followed by Tower (1.1%), Powerchip (1%), Nexchip (1%) and Vanguard (1%), according to TrendForce.

Missing from the rankings is U.S.-based Intel. The market share figures aren’t set in stone. This could change in the next few quarters, as the foundry market is a dynamic business.

Nonetheless, the business outlook for foundry vendors is a mixed picture. Some vendors are seeing enormous demand in one particular segment: high-performance computing (HPC). HPC involves large computers, or servers, that reside in datacenters at Amazon, Google, Meta, Microsoft and others. The servers incorporate leading-edge chips from Nvidia and others, which are processing enormous amounts of data. Within the overall server market, the fastest-growing segment involves AI servers, which are being used to process the latest and most complex AI algorithms like ChatGPT.

The other key growth markets for foundries, namely automotive, consumer, industrial and smartphones, are seeing lackluster growth. Sluggish demand and high chip inventories have impacted growth.

There are signs of improvement. “We expect the demand for AI to remain strong in 2024, and probably more upsides in 2025,” said Adam Chang, an analyst at Counterpoint Research. “However, non-AI demand remained sluggish, but we think the inventory set-up is promising after several quarters of de-stocking.”

In total, the global foundry industry’s revenue declined by 5% in the first quarter of 2024, as compared to the previous period, according to Counterpoint. But worldwide foundry sales grew 12% year-over-year, they added.

The numbers

2024 is expected to be a mixed bag in the electronics industry. Worldwide smartphone shipments are forecasted to grow 4% year-over-year in 2024 to 1.21 billion units, according to IDC.

The worldwide PC market is expected to remain flat in 2024, with shipments reaching 260.2 million units, according to IDC. A new category of PCs—called AI PCs--are beginning to emerge and could jumpstart the market. AI PCs are souped-up PCs with onboard neural processing units (NPUs).

In the semiconductor industry, meanwhile, 2024 is a recovery year following a downturn last year. In 2023, the worldwide semiconductor market reached $526.9 billion, down 8.2% over 2022, according to the World Semiconductor Trade Statistics (WSTS) organization.

In terms of sales, the worldwide semiconductor market is projected to hit $611.2 billion in 2024, up 16% over 2023, according to the WSTS. 2024 is expected to be a tale of two halves. The first half of the year was relatively slow, but demand is expected to pick up in the second half.

Looking ahead to 2025, WSTS forecasts 12.5% growth in the global semiconductor market, reaching an estimated valuation of $687 billion.

2025 is a big year in other respects. In total, 17 new fab lines for chip production are scheduled to begin operations in 2025, up from 12 in 2024, according to the Global Wafer Capacity 2024 report from Knometa. (See below for the list of new fabs.)

These new fabs are located in China, Japan, Korea, Singapore, Taiwan and the U.S. Some new fabs are owned and operated by foundry companies. Others are owned by memory vendors. Fabs are expensive to build and equip. An advanced fab can cost anywhere from $10 billion to $20 billion each.

In any case, the semiconductor industry is expected to see record volumes of IC wafer capacity coming online in 2025. At the end of 2023, the worldwide semiconductor industry had a total installed capacity of 275.5 million 200mm-equivalent wafers per month, according to Trevor Yancey, president of Knometa. “At the end of 2024, total installed capacity is 287.7 million wafers per month,” Yancey said.

In other words, the amount of global IC capacity is projected to increase by 12.2 million 200mm-equivalent wafers in 2024 over 2023, representing a 4% growth rate, according to Knometa. Knometa predicts that 23.1 million 200mm-equivalent wafers per year of capacity will be put into production in 2025, surpassing the previous high of 18.5 million wafers in 2021.

The foundry vendors

TSMC

There are at least two-dozen or more companies that compete in the foundry business. Foundry vendors come in different sizes. Each one has a different strategy, with different technology offerings.

TSMC is still the foundry leader. During the first quarter of 2024, TSMC saw robust growth in the HPC segment. However, the smartphone market was sluggish for TSMC and other foundries.

“Looking at the full year 2024, macroeconomic and geopolitical uncertainty persists, potentially further weighing on consumer sentiment and end-market demand. We thus expect the overall semiconductor market, excluding memory, to experience a more mild and gradual recovery in 2024,” said C. C. Wei, chief executive of TSMC, in a recent conference call.

TSMC makes chips based on a wide range of trailing- and leading-edge process technologies. Process technologies involve the design rules and recipes used in manufacturing a given chip line.

For some time, TSMC has been manufacturing chips based on its most advanced process--3nm. In 2025, TSMC is expected to make chips based on its next-generation 2nm process. The company is also making a major transistor transition here. Each chip consists of a multitude of tiny transistors, which act like electronic switches in devices.

Up until the 2010s, Intel, TSMC and others made chips that incorporated relatively simple planar transistor structures. Then, at the 22nm node in 2011, Intel migrated to a more advanced and faster transistor type called the finFET.

Later, GF, Samsung and TSMC also migrated to finFETs. In other words, chipmakers started to make their most advanced chips, which incorporated tiny and fast finFET transistors.

TSMC has extended traditional finFET transistors to today’s 3nm node, but this transistor type will soon hit its physical limits. So, starting at the 2nm node in 2025, TSMC will migrate to a new transistor type called the nanosheet FET. It’s also known as a gate-all-around (GAA) transistor. Nanosheet FETs provide better performance than finFETs, but they are harder and more expensive to make in the fab.

In 2025, TSMC is also bringing up a new fab into production. That 300mm facility, called Fab 18 Phase 8, is located in Tainan, Taiwan, according to Knometa.

Samsung

Samsung remains in second place in the foundry rankings. During the first quarter, Samsung’s foundry business saw lackluster market demand, particularly in the smartphone segment.

Unlike TSMC, Samsung migrated to nanosheet FETs at the 3nm node. Today, Samsung is making select chips using nanosheet FET transistors, although the yields are still shaky. Soon, Samsung will move into production with its second-generation nanosheet FET at the 3nm node, with 2nm in R&D.

In 2025, Samsung is expected to bring up a new fab in Pyeongtaek, South Korea. That 300mm fab, called P4, will make memory chips (3D NAND and DRAMs), according to Knometa.

SMIC

In the first quarter, SMIC moved into third place in the foundry rankings. During the quarter, SMIC saw some growth in the consumer and smartphone markets.

SMIC makes chips based on a range of processes. The company recently moved into production with a 7nm-like process, which is China’s most advanced technology. The yields are shaky, though. SMIC is making 7nm chips for use in Huawei’s smartphones.

In R&D, SMIC is working on a 5nm process and beyond, but it faces some major challenges. Due to export control restrictions from the U.S., SMIC is prohibited from obtaining some key fab equipment to help develop its 5nm and beyond processes. So, SMIC is developing 5nm technologies without using this key equipment. In theory, it’s possible to accomplish this feat. But it’s also much harder and more costly to do so.

In 2025, SMIC is also expected to bring up a new 300mm fab (SN2) in Shanghai, according to Knometa.

UMC

UMC remained in fourth place in the foundry rankings. In the first quarter, UMC saw improved demand in several segments. “Contribution from our specialty business increased to 57% of total revenue, driven by demand for power management ICs, RFSOI chips, and silicon interposers for AI servers,” said Jason Wang, co-president of UMC.

UMC’s most advanced process is based on a 28nm/22nm technology. UMC and Intel are co-developing a 12nm finFET process.

In 2025, UMC is expected to move into production with a new 300mm fab in Singapore (Fab 12i, Phase 3).

GlobalFoundries, Huahong, other foundries

GF fell from third to fifth place in the latest rankings. In the first quarter of 2024, GF was impacted by high chip inventories, although the situation is improving. Automotive is a bright spot for GF. GF makes chips based on processes at 14nm/12nm and above.

China’s Huahong remained in sixth place in the rankings. The company offers a broad selection of mature processes. It is also building its second 300mm fab, which will be in operation by year’s end.

Tower (Israel), Powerchip (Taiwan), Nexchip (Taiwan/China), Vanguard (Taiwan) and others are also viable foundry vendors. Powerchip, for one, has made some recent headlines. First, the company is building a new fab in Japan. Then, Powerchip will assist India's Tata Electronics to build India's first 300mm fab.

Meanwhile, Taiwan’s Vanguard and NXP recently announced a joint 300mm fab venture in Singapore. Slated for production in 2027, the joint-venture fab will support 130nm to 40nm mixed-signal, power management and analog products.

Intel is also a foundry player. Intel’s foundry business entered TrendForce’s top-ten foundry rankings for the first time in the third quarter of 2023. But Intel’s foundry business was pushed out of the rankings by the fourth quarter of 2023.

Still, Intel has some ambitious plans. Intel is behind TSMC and Samsung in advanced logic process technology. To play catch-up, Intel is in the midst of developing five processes in four years. In 2025, Intel hopes to regain the lead with its 18A process, which is based on nanosheet technology.

China’s Pengxin Micro is also worth watching. The Shenzhen-based foundry company is building a new 300mm fab, which will process chips at the 28nm/20nm nodes and above. It will reportedly make chips for Huawei.

More fabs

Seventeen new fab lines for IC production are scheduled to begin operations in 2025, according to Knometa. These include the following:

*HH Grace (Huahong Group) – Wuxi, China – 300mm wafers for foundry services

*Intel – New Albany, Ohio – 300mm wafers for advanced logic and foundry

*JS Foundry – Ojiya, Niigata, Japan – 200mm wafers for ICs (and discretes)

*Kioxia – Kitakami, Iwate, Japan – 300mm wafers for 3D NAND

*Micron – Boise, Idaho – 300mm wafers for DRAM

*Pengxin Micro – Shenzhen, China – 300mm wafers for foundry

*Samsung – Pyeongtaek, Korea (P4 fab) – 300mm wafers for 3D NAND and DRAM

*SK Hynix – Dalian, China (Fab 68 expansion) – 300mm wafers for 3D NAND

*SMIC – Shanghai, China (SN2 fab) – 300mm wafers for foundry

*TI – Sherman, Texas – 300mm wafers for analog and mixed-signal

*TSMC – Tainan, Taiwan (Fab 18, Phase 8) – 300mm wafers for foundry

*UMC – Singapore (Fab 12i, Phase 3) – 300mm wafers for foundry