Silicon Wafer Biz To Recover After Downturn in ‘24

Silicon wafers are a key part of the semiconductor industry. What’s the outlook for these products?

By Mark LaPedus

Global shipments of silicon wafers are projected to decline in 2024, but the market is expected to rebound and grow in 2025, according to SEMI, a trade group.

In total, worldwide shipments of silicon wafers are projected to decline by 2.4% to 12,174 million square inches (MSI) in 2024, according to a new forecast from SEMI.

But in 2025, worldwide shipments of silicon wafers are projected to rebound and reach 13,328 MSI, up 9.5% over 2024, according to the forecast from SEMI.

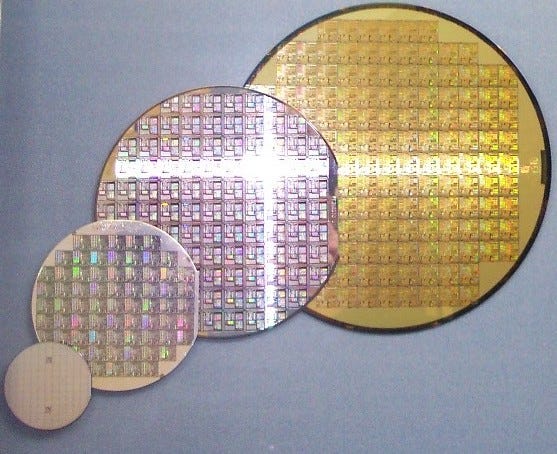

Silicon wafers are a key part of the semiconductor supply chain. Basically, in a facility, silicon wafer suppliers develop round and thin wafers at various diameter sizes, such as 150mm, 200mm and 300mm. Based on high-purity silicon materials, these wafers are sold to chipmakers, such as Intel, Micron, TSMC, Samsung, TI and others. Chipmakers, in turn, take these wafers and process them into chips in semiconductor manufacturing facilities or fabs.

Silicon wafer makers develop different types of wafers. 300mm wafers are used to manufacture logic, memory and other chip types. 200mm wafers are used to make chips based on more mature processes, such as analog devices, RF products and others.

Japan’s Shin-Etsu is the leader in the silicon wafer business in terms of worldwide market share, followed in order by Japan’s Sumco and Taiwan’s GlobalWafers. Siltronic (Germany), SK Siltron (Korea), Soitec (France) and others make wafers. Suppliers from China are also producing silicon wafers

Silicon wafers at various sizes Source: Wikipedia

The silicon wafer business is cyclical and reflects the overall state of the semiconductor industry. In total, the semiconductor industry experienced a decline of 8.2% in 2023 over 2022, according to the World Semiconductor Trade Statistics (WSTS) organization. The decline was due to lackluster demand and bloated chip inventories in the channels.

Suppliers of silicon wafers also saw a similar situation in 2023. In total, worldwide silicon wafer shipments in 2023 decreased by 14.3% to 12,477 MSI, according to SEMI.

The semiconductor industry experienced a modest recovery in the first half of 2024. Thanks to Nvidia, the AI chip market has seen unprecedented growth. The non-AI chip markets, however, were lackluster at best.

The same is true for the silicon wafer industry. “During the first half of fiscal year 2024 (January 1, 2024–June 30, 2024), the semiconductor market as a whole continued to recover, driven by strong demand for data center use with the advance of AI, despite ongoing demand weakness in semiconductors for consumer, industrial, and automotive uses,” said Mayuki Hashimoto, president and chief executive of Sumco, in a recent presentation to shareholders. “As a result, demand for 300mm silicon wafers entered a recovery phase, centering around leading-edge products for data centers to meet AI needs, while the slow pace of shipments of wafers of 200mm and smaller continued.”

Going forward, the semiconductor market, as well as the silicon wafer industry, appears to be a mixed picture in the second half of 2024. “In addition to the recovery of demand for data center use with growing AI utilization, we expect a recovery also for personal computer, smartphone, and automotive uses, whereas consumer and industrial applications are likely to see continued weak demand. Since it will take time for customers to draw down their inventories of wafers other than those for leading-edge products, we expect the recovery in demand for 300mm silicon wafers to continue at a gradual pace, while weak demand is expected to continue for 200mm and smaller wafers,” Hashimoto said.

In 2024, the semiconductor industry is expected to reach $611 billion in terms of sales, up 16% over 2023, according to the WSTS. Looking ahead to 2025, WSTS forecasts a 12.5% growth in the global semiconductor market, reaching an estimated valuation of $687 billion.

Overall, the high-performance computing (HPC) chip market has been a bright spot in 2024. HPC involves AI chips, GPUs, processors and other products used in high-end computers like servers. One company, Nvidia, continues to see enormous demand for its GPUs with no signs of letting up.

Demand for chips in PCs and smartphones remain steady in some areas and sluggish in others in 2024. But chip demand for automotive and industrial applications has been lackluster at best this year.