Silicon wafer market: upturn, higher prices

Wafer suppliers are beginning to see signs of a recovery with possible price hikes seen in the arena. China is also lurking in the silicon wafer business.

By Mark LaPedus

After experiencing a downturn in 2023, suppliers of silicon wafers are beginning to see signs of a recovery in 2024.

Silicon wafer suppliers, a key part of the semiconductor ecosystem, indicate that the year-long slump in the silicon wafer market hit the bottom in the first quarter of 2024. Suppliers now expect that a gradual recovery will take place starting in the second half of 2024.

Also look for prices to increase for select silicon wafer products this year. China’s domestic silicon wafer industry is also worth watching.

Silicon wafer suppliers aren’t household names, but they are an important part of the semiconductor industry. Japan’s Shin-Etsu is the leader in the silicon wafer business in terms of market share, followed in order by Japan’s Sumco and Taiwan’s GlobalWafers.

Siltronic (Germany), SK Siltron (Korea), Soitec (France) and others make wafers. For years, China has been developing its own silicon wafer industry, but it has yet to make a dent in the international market, at least for now.

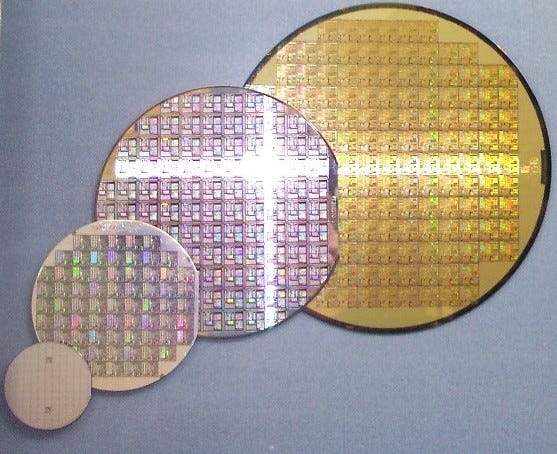

Silicon wafers are required for the production of all semiconductors or chips. Basically, in a facility, silicon wafer suppliers develop round and thin raw wafers at various diameter sizes, such as 150mm, 200mm and 300mm.

[2-inch (51mm), 4-inch (100mm), 6-inch (150mm), and 8-inch (200mm) wafers. Credit: Wikipedia]

To make silicon wafers, suppliers use the age-old Czochralski (CZ) process. For this, suppliers first inject polysilicon materials, along with small amounts of boron and phosphorous, into a quartz crucible, according to Sumco. The crucible resembles a long, round oblong vessel.

The materials are melted in the crucible at high temperatures. Then, a crystal silicon rod is placed in the crucible. The rod pulls up a long monocrystalline ingot from the crucible. The ingot is rotated.

At that point, the long, oblong monocrystalline ingot is placed on its side in a wire saw machine. In the machine, the saw cuts the ingot into slices of round silicon wafers at a thickness of around 1mm each.

The raw and round wafers are then polished. Based on high-purity silicon materials, these unprocessed wafers are sold to chipmakers, such as Intel, Micron, TSMC, Samsung, TI and others. Chipmakers in turn take these raw wafers and process them into chips in semiconductor manufacturing facilities or fabs.

Silicon wafer makers develop different types of raw wafers. Epitaxial (epi) wafers and polished wafers are the most common types. Epi wafers are used by chipmakers to manufacture logic chips (GPUs, processors). Polished wafers are used by memory makers to make DRAMs and flash memories.

Some suppliers make specialty wafers. These include wafers for gallium-nitride (GaN) chips, silicon carbide (SiC) power devices, and silicon-on-insulator (SOI) products.

The silicon wafer business is cyclical and reflects the state of the semiconductor industry. In total, the semiconductor industry experienced a decline of 8.2% in 2023 over 2022, according to the WSTS. The decline was due to lackluster demand and bloated chip inventories.

This in turn impacted the silicon wafer business. Silicon wafer shipments reached 12,602 million square inches in 2023, down 14.3% from 2022, according to the SEMI Silicon Manufacturers Group (SMG). Overall silicon wafer revenues declined by 10.9% to $12.3 billion in 2023, according to SMG.

"Shipments of 12-inch (300mm) polished and epi wafers contracted 13% and 5% in 2023, respectively,” said Lee Chungwei, chairman of SEMI SMG and vice president and chief auditor at GlobalWafers.

Going forward, citing an upturn in the memory business and other factors, the semiconductor market is expected to recover and grow by 13.1% in 2024, according to the WSTS.

Still, for silicon wafer suppliers, the first half of 2024 looks difficult amid an ongoing inventory glut for both 200mm and 300mm wafers in the market. The second half of 2024 looks better for wafer makers, thanks to a more robust demand picture and a reduction of inventories in the market. The net result is that silicon wafer industry will experience a flat to slightly down year in 2024, analysts said.

Supply/demand/pricing picture

Some wafer products are seeing more demand than others. For example, the 300mm silicon wafer market is expected to rebound in 2024, but it’s a different story for 200mm.

200mm silicon wafers are used to make chips at more mature processes. These types of chips are found in appliances, cars, displays, PCs and phones. Some of these markets, such as automotive, are in a slump.

Suppliers saw weak and declining demand for 200mm silicon wafers in 2023. 2024 also looks sluggish for the 200mm wafer market.

300mm has a brighter outlook. In 2023, the market was slow for both 300mm logic (epi) and memory (polished) wafers. The sluggish market is expected to extend into the first half of 2024.

In the second half of 2024, though, the 300mm epi wafer market is expected to recover and see renewed demand, according to Sumco. In the second half of this year, the 300mm polished wafer business is expected to rebound sometime after the epi wafer recovery.

AI servers, according to Sumco, will help drive the demand for 300mm epi wafers. Generally, Amazon, Google, Meta, Microsoft and others each have a number of large computing facilities called datacenters. Datacenters process an enormous of amount of information and data using large computers called servers. Most of these traditional servers run general-purpose applications.

In contrast, AI servers incorporate more advanced chips like GPUs. These systems handle data-intensive AI workloads, such as ChatGPT algorithms. AI servers are still a small part of the overall server market, but it’s growing.

Some 1.8 wafers are required to produce the chips used in one AI server, according to Sumco. An AI server consumes 3.4 times more silicon area as compared to a traditional server, they added.

What about prices for silicon wafers? Prices for silicon wafers tend to reflect the supply and demand situation for these products. In 2024, suppliers of silicon wafers may raise their prices for some but not all products.

“LTA prices are expected to rise because they include cost increases due to capital investment and raw material price increases,” according to Shin-Etsu, in its most recent results.

Silicon wafer suppliers have various types of supply and pricing contract agreements with their customers (chipmakers). These contracts are called long-term agreements (LTAs).

There are two types of LTA contracts—fixed and step-up. In fixed LTA contracts, prices for silicon wafers remain fixed for a set period. So in 2024, prices for silicon wafers aren’t expected to rise for customers with fixed LTA contracts.

In step-up LTA contracts, though, wafer prices tend to increase every year. Those customers could see price hikes in 2024, although there are exceptions to the rule.

There is another sales channel for silicon wafers. In some cases, chipmakers can obtain silicon wafers on the spot or open market. Prices for those wafers tend to fluctuate.

What about China?

As stated, the silicon wafer market is dominated by the multinationals like Shin-Etsu, Sumco, GlobalWafers and others.

Still to be seen, however, is whether China can become a factor in the silicon wafer industry. One China-based company, Shanghai Xinsheng Semiconductor Technology, is a commercial supplier of 300mm silicon wafers. China-based Wafer Works is also shipping various wafer types.

So far, though, China-based suppliers have not made a sizable dent in the worldwide market. Generally, multinational chipmakers tend not to use wafers from China-based suppliers, simply because they don’t meet the required specifications. That, of course, could change some day.

So for the most part, China-based suppliers tend to focus more on selling their products to Chinese semiconductor suppliers.

To be sure, China is worth watching. Nonetheless, it’s going to be a long and steady recovery for the silicon wafer industry, that is, if all of the market forces cooperate.