TSMC Dominates Q2 Foundry Rankings

Many other foundry vendors saw their market share numbers slip during the quarter

By Mark LaPedus

TSMC maintained its dominant position in the foundry business, as the company’s market share reached a record 70.2% in the second quarter of 2025, according to TrendForce, a research firm.

Many other foundry vendors saw their market share numbers slip during the second quarter. The foundry industry, a key part of the semiconductor business, involves a number of companies called foundry vendors. These vendors make chips for other companies in large manufacturing facilities called fabs.

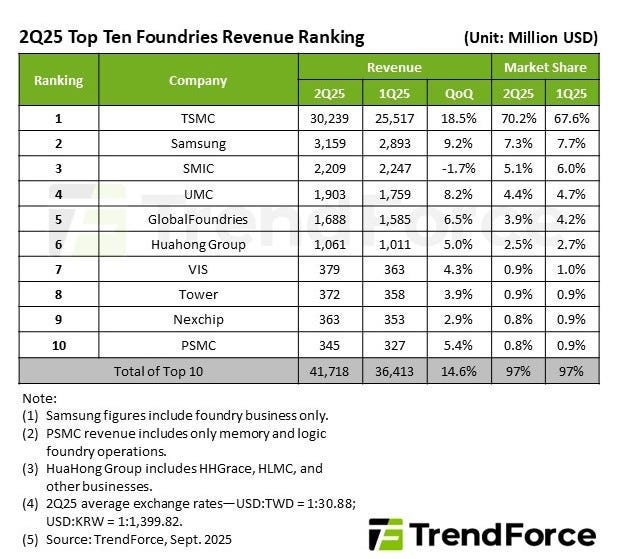

In the second quarter of 2025, TSMC remained in first place in the foundry rankings with a dominate 70.2% market share, followed in order by Samsung (7.3% share), SMIC (5.1%), UMC (4.4%), GlobalFoundries (3.9%), Hua Hong Group (2.5%), Vanguard (0.9%), Tower (0.9%), Nexchip (0.8%) and Powerchip (0.8%), according to TrendForce (See rankings chart below).

There were no changes in the foundry rankings, as compared to the first quarter of 2025. Intel, which is attempting to make inroads in the foundry business, is not in the top-10 rankings.

In the first quarter of 2025, global foundry revenues reached a record $41.7 billion, up 14.6% from the previous quarter, according to TrendForce. The growth was driven by China’s consumer subsidy program, along with demand for new smartphones, PCs and servers.

In January of 2025, China’s National Development and Reform Commission (NDRC) initiated a smartphone subsidy program for Chinese consumers. Consumers were given subsidies for devices priced below RMB6,000 (US$840) with a maximum subsidy of CNY500 ($70), according to TD Cowen.

“Similar to earlier this year, China's NDRC launched a new round of subsidies on August 20 that includes smartphones priced under RMB6,000,” said Krish Sankar, an analyst at TD Cowen, in a research note.

The subsidies could jumpstart demand in China. In the second quarter of 2025, smartphone shipments in China were down 10% year-over-year after seven quarters of growth, according to TD Cowen.

Other factors could also help drive demand in the foundry business. “Looking ahead to 3Q25, seasonal demand for new products will drive order momentum. Advanced nodes will benefit from strong demand for flagship chips, while mature nodes will be supported by peripheral IC orders,” according to TrendForce.

In the second quarter of 2025, the market dynamics were different for each foundry vendor. Here’s how each foundry vendor fared during the second quarter of 2025:

TSMC

Taiwan’s TSMC, the world’s largest foundry vendor, saw robust demand in the second quarter, due to booming orders from AMD, Apple, Broadcom, Nvidia and others. “TSMC reported outstanding performance, with major smartphone clients entering their ramp-up cycle and strong shipments of AI GPUs, notebooks, and PCs pushing wafer shipments and ASPs higher,” according to TrendForce.

TSMC is expected to ramp up its 2nm process later this year. In addition, the company is expected to start construction of its 1.4nm fab facilities at the Central Taiwan Science Park (CTSP) as early as October, according to the Taipei Times, citing the Liberty Times as its source.

CTSP is located in Taichung, a city in central Taiwan. TSMC’s 1.4nm process is called A14. Mass production for A14 is scheduled for 2028.

Samsung

South Korea’s Samsung, the world’s second largest foundry vendor, “also posted solid results, benefiting from smartphone demand and the ramp-up of the Nintendo Switch 2,” according to TrendForce.

Samsung is manufacturing Nvidia’s Tegra system-on-a-chip (SoC) design for Nintendo’s Switch 2 using its 8nm process, according to Businesskorea. In addition, Samsung has recently struck foundry deals with Tesla and DEEPX.

SMIC

China’s SMIC, the world’s third largest foundry vendor, lost share. “SMIC, while still supported by U.S. tariffs and China’s subsidies, struggled with lingering issues from its advanced-node production lines in the first quarter, which led to shipment delays and lower ASPs,” according to TrendForce.

For some time, SMIC has been shipping a 7nm finFET process. SMIC is working on a 5nm finFET process, but it is struggling with the technology. “Our supply chain checks suggest SMIC 7nm capacity is around 20K wspm and Huawei has procured ~15K wspm of this. Yields have improved to 60-70% compared to <40% when initially launched in C2H23. SMIC's ‘5.5nm’ node is believed to still be yielding low levels,” TD Cowen’s Sankar said.

UMC

Taiwan’s UMC, the fourth largest foundry vendor, “performed well, with gains in both shipments and ASPs (in the second quarter),” according to TrendForce.

UMC recently unveiled its new fab in Singapore. The new facility will produce chips using its 22nm and 28nm processes. Production will start in 2026.

GlobalFoundries (GF)

During the second quarter, U.S.-based GF benefitted “from new product stocking and modest ASP improvements,” according to TrendForce.

GF recently introduced a new RRAM and silicon germanium (SiGe) technology.

Hua Hong

China’s Hua Hong Group is a state-run semiconductor company. It has several subsidiaries, including two foundry companies--Hua Hong Semiconductor and Shanghai Huali (HLMC). Hua Hong Semiconductor is looking to acquire a controlling stake in HLMC, according to various reports.

Other foundries

Taiwan’s Vanguard and NXP recently formed a foundry joint venture.

Meanwhile, “Tower improved (its) utilization as clients resumed stocking for second-half launches,” according to TrendForce. “Nexchip also benefited from subsidy-driven demand and higher orders for peripheral ICs, though low pricing limited upside.”