Foundry Rankings Change In Q2

One foundry vendor moved up in the rankings, leapfrogging over two other companies in the arena.

By Mark LaPedus

There was a slight change in the top-10 rankings in the foundry industry for the second quarter of 2024.

One foundry vendor moved up in the rankings, leapfrogging over two other companies in the arena. The foundry industry, a key part of the semiconductor business, involves a number of companies called foundry vendors. These vendors manufacture semiconductors, or chips, for other companies in large manufacturing facilities called fabs. The rankings are based on a foundry vendor’s worldwide sales, or market share, during a given period.

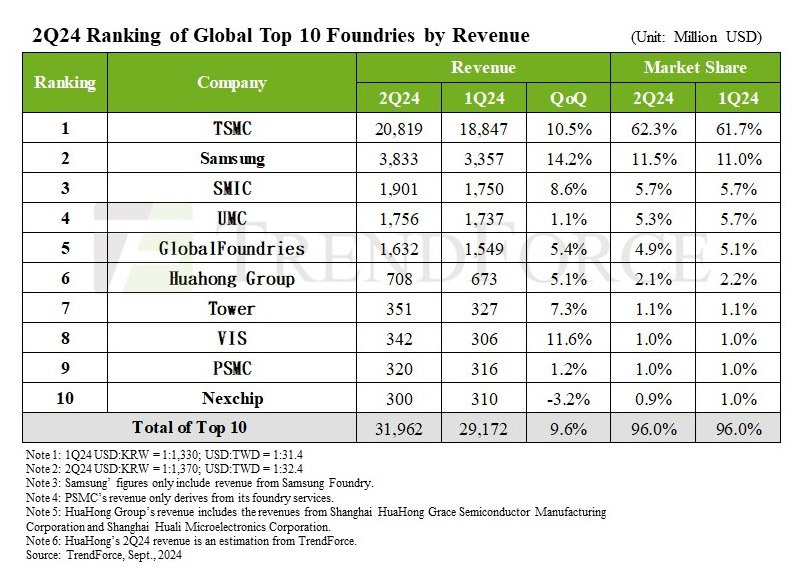

In the second quarter of 2024, TSMC remained in first place in the foundry rankings with a dominate 62.3% market share, followed in order by Samsung (11.5% share), SMIC (5.7%), UMC (5.3%), GlobalFoundries (4.9%), HuaHong Group (2.1%), and Tower (1.1%), according to TrendForce, a research firm.

There was no change in the foundry rankings among the top-7 vendors, as compared to the rankings in the first quarter of 2024.

In the second quarter, though, Vanguard jumped from tenth to eighth place, according to TrendForce. PSMC and Nexchip fell to ninth and tenth place, respectively, according to TrendForce. In the first quarter, PSMC and Nexchip were in eighth and ninth place, respectively.

Others also compete in the foundry business. In total, there might be two dozen or more foundry vendors worldwide. Intel competes in the foundry business, but it didn’t crack the top-10 rankings in the quarter. Intel is struggling in the arena. Amid a period of losses, layoffs and product miscues, Intel is exploring its options, including a potential separation or sale of its troubled foundry business, according to a report from Bloomberg.

Foundry vendors come in all sizes with different capabilities. A few vendors provide leading-edge manufacturing capabilities for foundry customers. Most offer mature or trailing-edge manufacturing capabilities for customers.

A few foundry vendors offer both trailing- and leading-edge chip manufacturing capabilities. A few even provide packages services to customers.

Nonetheless, for the second quarter of 2024, the worldwide foundry industry grew around 9% quarter-over-quarter and 23% year-over-year, according to Counterpoint Research. “In Q2 2024, the global foundry industry demonstrated resilience, with most of the growth primarily driven by robust AI demand and smartphone inventory restocking. Demand recovery across the semiconductor industry is progressing unevenly. While leading-edge applications such as AI semiconductors are experiencing strong growth, traditional semiconductors are recovering more slowly. Chinese foundries are rebounding faster due to earlier inventory corrections and increased restocking by local fabless customers. In contrast, non-Chinese foundries are experiencing a more gradual recovery,” said Adam Chang, an analyst at Counterpoint.

AI is a hot market, particularly at Nvidia. Nvidia continues to see enormous demand for its GPUs in the market. Nvidia’s GPUs are complex chips used for AI applications. However, Nvidia has recently suffered a slight setback. The company’s latest GPU, called Blackwell, has been delayed by three months. But Nvidia’s previous-generation GPUs are still in demand.

For some time, TSMC has benefitted from Nvidia’s GPU demand. TSMC is the main foundry vendor for Nvidia. TSMC is also the main foundry vendor for AMD, Apple, Qualcomm and others.

In recent times, foundry vendors have experienced lackluster demand in the non-AI sectors, such as automotive, consumer and industrial.

This is starting to change. China’s mid-year shopping season surge, coupled with lower inventory levels in the channels, have caused chip vendors and system houses to begin restocking components in several non-AI chip markets, resulting in rush orders for foundries, according to TrendForce.

In a recent blog, TrendForce talks about the foundry industry in the second quarter. Counterpoint Research posted a similar blog.