TSMC Addresses Q3 Results, 2nm, Capacity Shortages, U.S. fab

During a conference call, TSMC addressed a range of topics, including its quarterly results and what’s ahead for the foundry giant.

By Mark LaPedus

TSMC this week reported robust earnings for the third quarter of 2024, thanks in part to huge demand in the AI chip sector.

During a conference call to discuss its earnings, TSMC this week also addressed a range of topics, including demand for its upcoming processes, capacity shortages for its packaging technologies, and an update for its long-awaited Arizona fab.

On the earnings front, TSMC, the world’s largest foundry vendor, reported sales of US$23.50 billion for the third quarter of 2024, up 36% year-over-year and up 12.9% from the previous quarter. For the quarter, TSMC reported a net income of US$10.1 billion, up 52.2% year-over-year and up 31.2% from the previous quarter.

TSMC beat Wall Street’s expectations for the third quarter, thanks to robust demand from AMD, Apple, Nvidia and other foundry customers. Intel is also becoming a significant foundry customer for TSMC.

TSMC continues to benefit from the AI boom. The company manufactures Nvidia’s GPU devices, which are geared for AI applications. Nvidia is seeing overwhelming demand for its devices from the cloud service providers. GPUs, processors and related chip products fall under a product category called high-performance computing (HPC).

For TSMC, the HPC market increased 11% quarter-over-quarter to account for 51% of the company’s third-quarter revenue. The smartphone market increased 16% to account for 34% of TSMC’s sales. IoT increased 35% to account for 7%, while automotive increased 6% to account for 5%.

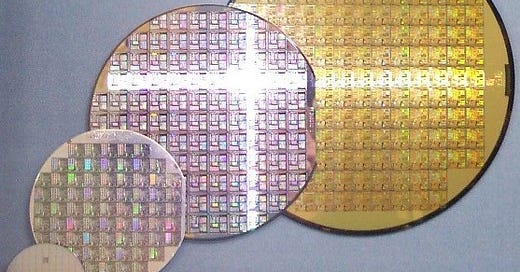

In the third quarter, shipments of chips based on TSMC’s 3nm process technologies accounted for 20% of the company’s total wafer revenue. TSMC’s 5nm process accounted for 32% of the company’s sales, while 7nm accounted for 17%. Advanced technologies, defined as 7nm and below, accounted for 69% of total wafer revenue.

Going forward, TSMC expects its fourth-quarter revenue to be between US$26.1 billion to US$26.9 billion, which represents a 13% sequential increase or a 35% year-over-year increase at the midpoint.

“Our business in the third quarter was supported by strong smartphone and AI-related demand for our industry-leading 3 nanometer and 5 nanometer technologies,” said C.C. Wei, chairman and chief executive of TSMC, in a conference call this week. “We expect our business to continue to be supported by strong demand for our leading-edge process technologies. We continue to observe extremely robust AI related demand from our customers throughout the second half of 2024, leading to increasing overall capacity utilization rate for our leading 3 nanometer and 5 nanometer process technologies.”

During the call, TSMC also addressed several other topics, including:

*Future processes--2nm, A16 demand

*Shortages for its packaging capacity

*An update on its Arizona fab

2nm, A16 demand picture

TSMC manufactures chips using a wide range of processes. In 2023, the company began manufacturing chips based on its 3nm process, which represents the company’s most advanced logic technology.

A process involves the design rules and recipes used in manufacturing a given chip line. A process also involves various building blocks to manufacture a chip. Transistors, one of the key building blocks in chips, are tiny structures that act like electronic switches in devices. Today’s advanced chips have billions of tiny transistors.

TSMC’s 3nm process involves making chips using finFET transistors. But the workhorse finFET transistor will run out of steam beyond the 3nm node.

So at the 2nm node and beyond, TSMC is migrating to a new transistor type called gate-all-around (GAA). TSMC is embracing a specific type of GAA technology called the nanosheet field-effect transistor (FET).

FinFET vs Gate-All-Around (GAA) Source: Lam Research

In 2025, TSMC is expected to ramp up its new 2nm process. Then, in the second half of 2026, TSMC is expected to release A16, a new and more advanced process. (Here is TSMC’s official roadmap.)

What’s the demand picture for TSMC’s 2nm and A16 processes? “Actually, we have many, many customers interested in 2 nanometer. And today, with their activities with TSMC, we actually see more demand than we ever dream about as compared with N3. So, we have to prepare more capacity in N2 than in N3. A16 is very, very attractive for AI server chips. And so actually the demand is also very high and so we are working very hard to prepare both 2 nanometer and A16 capacity,” Wei said during the conference call.

TSMC is not the first company to migrate to nanosheet FETs. In 2022, Samsung was the first company to ship chips using nanosheet FETs. Samsung introduced the technology at the 3nm node, beating Intel and TSMC to the punch in the GAA arena.

But Samsung’s strategy appears to have backfired. Reports have surfaced that Samsung is struggling with its yields at the 3nm node, causing it to possibly lose some foundry customers. Samsung’s 3nm yields are poor at best. Simply put, GAA is a difficult technology to master.

In 2025, Intel is also migrating to GAA at its so-called 18A process. Time will tell if Intel can make good on its promises here. To be sure, TSMC also faces some challenges in terms of migrating from finFETs to GAA.

Advanced packaging

Advanced packaging only represents about a high single-digit percentage of TSMC’s sales. Yet, advanced packaging is an important part of TSMC’s business.

Take Apple for example. For years, TSMC has manufactured Apple’s application processor for the iPhone. TSMC also assembles the device in an advanced package within its manufacturing facilities in Taiwan.

TSMC is capable of assembling chips in different advanced package types. Today, TSMC’s hottest package type is a technology called Chip-on-Wafer-on-Substrate (CoWoS), which is basically a 2.5D package. Nvidia and others use TSMC’s CoWoS technology for their respective devices.

But for some time, TSMC has experienced greater than expected demand for CoWoS, thereby creating capacity shortages for the technology. Nvidia and others can’t seem to secure enough packaging capacity from TSMC.

These shortages are expected to persist for the foreseeable future. “We are putting a lot of effort to increase the capacity of CoWoS. Today's situation is our customer’s demand far exceeds our ability to supply. So even (if) we work very hard and increase the capacity by about more than twice, more than two times as of this year compared with last year, and probably double again, (it is) still not enough. But anyway, we are working very hard to meet the customer's requirement,” Wei said during the conference call.

Arizona fab

In 2020, TSMC announced plans to build a new advanced fab in Arizona, representing its most advanced facility outside of Taiwan. That fab will produce 4nm chips for Apple and perhaps others.

It hasn’t been easy to get the U.S. fab off the ground. First, there aren’t enough skilled fab workers in the U.S. Then, TSMC clashed with labor unions in Arizona.

Last year, TSMC delayed the production schedule of the fab from 2024 to 2025. Then, in April 2024, TSMC obtained $6.6 billion in CHIPS funding, which in turn helped jumpstart the Arizona fab.

“Our first fab (in the United States) entered engineering wafer production in April with 4 nanometer process technology, and the result is highly satisfactory, with a very good yield. This is an important operational milestone for TSMC and our customers, demonstrating TSMC’s strong manufacturing capability and execution,” Wei said during the conference call. “We now expect volume production of our first fab to start in the beginning of 2025 and are confident to deliver the same level of manufacturing quality and reliability from our fab in Arizona, as from our fabs in Taiwan.”