TSMC Tops New Foundry Rankings, Samsung Loses Ground

Is China's SMIC ramping up a 5nm process?

By Mark LaPedus

TSMC maintained its dominant position in the latest foundry rankings, but Samsung Foundry and a few others continue to lose ground in the arena, according to a new report from TrendForce, a market research firm.

The foundry industry, a key part of the semiconductor business, involves a number of companies called foundry vendors. These vendors make chips for other companies in large manufacturing facilities called fabs.

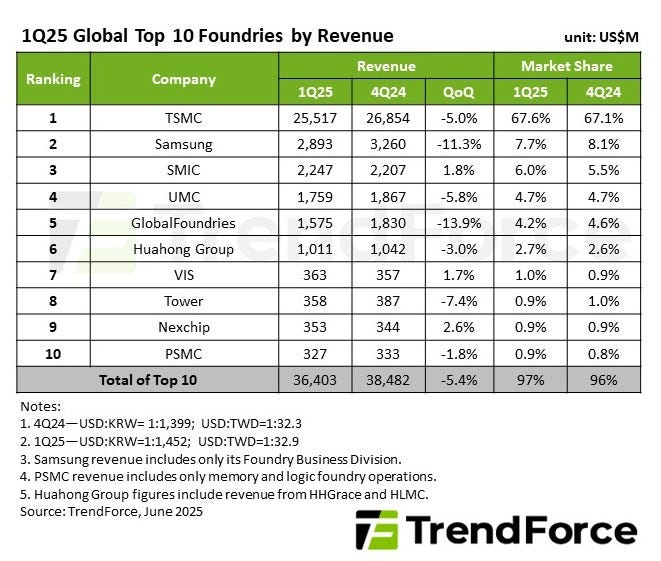

In the first quarter of 2025, TSMC remained in first place in the foundry rankings with a dominate 67.6% market share, followed in order by Samsung (7.7% share), SMIC (6%), UMC (4.7%), GlobalFoundries (4.2%), Hua Hong Group (2.7%), Vanguard (1%), Tower (0.9%), Nexchip (0.9%) and Powerchip (0.9%), according to TrendForce. (See rankings chart below)

According to TrendForce’s rankings, Vanguard rose from eighth to seventh place, while Tower fell from seventh to eighth place.

Beyond that, there were no changes in the foundry rankings in the first quarter of 2025, as compared to the rankings in the fourth quarter of 2024. Intel, which is attempting to make inroads in the foundry business, is not in the top-10 rankings.

In total, the global foundry industry recorded revenue of $36.4 billion in the first quarter of 2025, down 5.4% from the fourth quarter of 2024, according to TrendForce. “The downturn was softened by last-minute rush orders from clients ahead of the U.S. reciprocal tariff exemption deadline, as well as continued momentum from China’s 2024 consumer subsidy program. These factors help offset the typical seasonal slump,” according to the firm.

The Chinese government recently began offering subsidies to consumers in China for select products in an effort to jumpstart demand. “National subsidies now include smartphones, tablets, smart bands and smartwatches, with a 15% subsidy for products priced under CNY6,000 (approximately US$818) and capped at CNY500 per product,” said Amber Liu, research manager at Canalys, a research firm.

In the first quarter of 2025, the market dynamics were different for each foundry vendor. Here’s how each foundry vendor fared during the first quarter of 2025:

TSMC

Taiwan’s TSMC, the world’s largest foundry vendor, maintained its dominant position in the foundry business with 67.6% market share in the first quarter of 2025.

“While (TSMC’s) smartphone-related wafer shipments declined due to seasonal factors (in the first quarter of 2025), solid AI HPC demand and urgent TV-related orders (linked to tariff avoidance) helped limit its revenue drop to 5%, totaling $25.5 billion,” according to TrendForce.

In the second half of 2025, TSMC is expected to ramp up its new 2nm process. At the 2nm node and beyond, TSMC is migrating to a new transistor type called gate-all-around (GAA). TSMC is embracing a specific type of GAA technology called the nanosheet field-effect transistor (FET).

Samsung

South Korea’s Samsung, the world’s second largest foundry vendor, continues to struggle due to lackluster chip yields and other factors. Samsung Foundry’s sales fell 11.3% quarter-over-quarter, posting Q1 revenue of $2.89 billion.

“(Samsung Foundry’s) limited exposure to China’s consumer subsidy benefits, compounded by the U.S.’s advanced node restrictions, contributed to the decline. Market share dipped slightly to 7.7%,” according to TrendForce.

Samsung Foundry’s share continues to fall. The unit’s share was at 11% in the first quarter of 2024, according to TrendForce.

Like TSMC, Samsung hopes to ship its 2nm nanosheet technology in the second half of 2025.

SMIC

China’s SMIC, the world’s third largest foundry vendor, is gaining ground on Samsung Foundry. “SMIC benefited from early stocking in response to both U.S. tariffs and Chinese subsidies. This helped mitigate ASP declines, resulting in a 1.8% revenue increase to $2.25 billion, which placed the company in third place,” according to TrendForce.

Reports have also surfaced that Huawei has launched a PC line based on the Kirin X90, a 5nm chip. Huawei’s Kirin X90 chip is manufactured using SMIC’s new 5nm process—without using extreme ultraviolet (EUV) lithography. SMIC is using 193nm immersion lithography, coupled with multiple patterning, to produce the chip.

TD Cowen, an investment banking firm, believes that SMIC’s 5nm process actually resembles a ‘‘5.5nm’’ technology. SMIC’s 5.5nm process is still in the pilot line production stage with low yields, analysts said.

UMC

Taiwan’s UMC retained its fourth position in the rankings. “Early customer stocking helped keep wafer shipments and capacity utilization steady, though ASPs declined due to an annual pricing adjustment. Revenue edged down 5.8% to $1.76 billion,” according to TrendForce.

UMC recently unveiled its new fab in Singapore. The new facility is equipped for manufacturing UMC’s 22nm and 28nm processes. The first phase of the new facility will start volume production in 2026.

GF

U.S.-based GlobalFoundries (GF), “whose customers primarily placed orders for markets outside of China, did not benefit from the subsidy program. Combined with seasonal weakness, wafer shipments and ASPs declined, pulling revenue down 13.9% to $1.58 billion and slightly shrinking its market share,” according to TrendForce.

GF plans to invest $16 billion to expand its semiconductor manufacturing and advanced packaging capabilities across its facilities in New York and Vermont.

Hua Hong

China’s Hua Hong Group placed sixth with $1.01 billion in revenue, down 3%. “New capacity from HHGrace contributed, with selective low-price strategies attracting new orders. However, revenue declined post-merger with HLMC and other subsidiaries,” according to TrendForce.

Hua Hong is ramping up a new 300mm fab in China. In addition, STMicroelectronics last year expanded its collaboration with Hua Hong. The goal is to produce 40nm microcontrollers within a fab in China by the end of 2025, according to reports.

Vanguard

Taiwan’s Vanguard rose to seventh place with revenue up 1.7% to $363 million. “Tariff and subsidy-driven pre-stocking lifted utilization rates above typical off-season levels. Revenue grew while ASPs declined due to a higher mix of low-end products,” according to Vanguard.

Vanguard and NXP recently formed a foundry joint venture.

Tower

Isreal’s Tower dropped to eighth with revenue of $358 million, down 7.4%. “It was hit hard by seasonal weakness and did not benefit from China subsidies,” according to TrendForce.

Nexchip

“Nexchip climbed to ninth with revenue increasing 2.6% to $353 million, supported by urgent orders tied to U.S. tariffs and China subsidies,” according to the firm. Located in China, NexChip is a joint venture between China’s Hefei Construction Investment Holding and Taiwan’s Powerchip (PSMC).

Powerchip

Taiwan’s PSMC rounded out the top ten with $327 million in revenue, down 1.8% QoQ. “While memory foundry demand weakened, rush consumer orders helped keep utilization steady,” they added.