Memory Suppliers Post Mixed Financial Results

Updated: Sandisk posts $1.9B loss; Samsung posts mixed results amid memory price hikes; Everspin posts loss: SK Hynix posts mixed results, sees huge HBM demand; Micron sees HBM demand

By Mark LaPedus

Needless to say, memory companies are an important part of the semiconductor business. These vendors develop and sell DRAMs, flash memory and various next-generation memories. Here's the latest financial results from these companies:

Sandisk

In February, Sandisk completed its separation from Western Digital Corp. (WDC) and became a standalone publicly traded company. Sandisk sells solid state drives (SSDs) based on its own 3D NAND technology. WDC sells hard disk drives.

On May 7, Sandisk reported its fiscal third quarter financial results. Third quarter revenue was $1.70 billion, down 10% sequentially but above the guidance range. Third quarter GAAP loss was $1.93 billion, including a $1.83 billion goodwill impairment charge. That compares to a profit of $104 million in the previous quarter.

Bit shipments were down in the low-single digit range. Average selling prices (ASPs) were down in the high-single digit range.

For the fourth quarter, Sandisk expects its sales to be between $1.75 billion to $1.85 billion.

Samsung

On April 30, South Korea’s Samsung reported its financial results for the first quarter ended March 31, 2025.

Samsung posted mixed results amid lackluster demand and product setbacks in the quarter. In the overall memory market, uncertainty with the tariffs is causing buyers of DRAM and NAND devices to stockpile these products. Plus, contract memory prices are expected to increase.

Samsung posted KRW 79.14 trillion (US$55.0 billion) in consolidated revenue, an all-time quarterly high, on the back of strong sales of its flagship Galaxy S25 smartphones and other products. Sales were up 4% from the previous quarter and up 10% year-over-year.

Operating profit increased to KRW 6.7 trillion (US$4.7 billion) despite headwinds for the DS Division, which experienced a decrease in quarterly revenue. Operating profit was up 0.2% from the previous quarter and up 0.1% year-over-year.

Samsung’s semiconductor unit, called the DS Division, posted mixed results. Sales were down 17% from the previous quarter but up 9% year-over-year. Operating profit was down 1.8% from the previous quarter and down 0.8% year-over-year.

Samsung’s memory business was driven by expanded server DRAM sales and a rebound in demand for NAND. “However, overall earnings were impacted by the erosion of average selling price (ASP), as well as a decrease in HBM sales due to export controls on AI chips and deferred demand in anticipation of upcoming enhanced HBM3E products,” according to Samsung. “Earnings for the foundry business were muted due to sluggish seasonal mobile demand, inventory adjustments and stagnant fab utilization.”

In the foundry segment, Samsung hopes to ramp up its 2nm process by the second half of 2025. TSMC is also ramping up its 2nm technology. Intel is ramping up 18A, a 1.8nm technology.

Thanks to a boom in the high bandwidth memory (HBM) market, SK Hynix has overtaken Samsung for the first time in the worldwide DRAM business in terms of market share, according to Counterpoint Research.

SK Hynix continues to see strong demand for HBM. The company has dominated the HBM market with 70% market share, according to Counterpoint. Micron is also seeing strong demand for HBM, but Samsung is struggling in the arena.

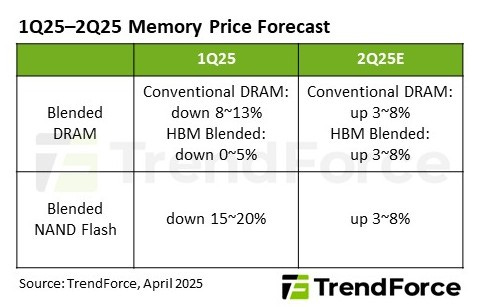

All memory suppliers are still evaluating the impact of the tariffs. But the tariffs are causing buyers of DRAM and NAND to stockpile these products, according to TrendForce.

Thus, memory contract prices are set to rise in the second quarter of 2025, according to TrendForce. “Lingering uncertainty over the direction of U.S. trade policy has driven memory buyers to adopt a more defensive stance—actively raising DRAM and NAND flash inventory levels as a buffer against supply risk,” according to the firm.

TrendForce notes that this proactive stockpiling has expanded the anticipated contract price increases for both DRAM and NAND flash in the second quarter. “However, this surge in momentum is likely to be short-lived,” according to the firm.

Everspin

On April 30, Everspin Technologies, a supplier of magnetoresistive random access memory (MRAM) products, announced its financial results for the first quarter ended March 31, 2025.

The company’s sales were $13.1 million in the quarter, compared to $14.4 million in the first quarter of 2024. Everspin posted a GAAP net loss of $1.2 million, or $(0.05) per diluted share, compared to net loss of $0.2 million, or $(0.01) per diluted share, in the first quarter of 2024.

MRAM product sales, which include both Toggle and STT-MRAM revenue, were $11.0 million in the quarter, compared to $10.9 million in the first quarter of 2024. Everspin recently announced that its MRAM products are validated for configuration across all Lattice’s FPGAs.

For the second quarter 2025, Everspin expects total revenue in a range of $12.5 million to $13.5 million and GAAP net (loss) income per basic share to be between $(0.05) and $0.00.

SK Hynix

South Korea’s SK Hynix reported mixed results in the first quarter of 2025. The company continues to see strong demand for high bandwidth memory (HBM) in the market. It is still assessing the impact of the tariffs in the marketplace.

On April 24, SK Hynix reported 17.6 trillion won (US$12.28 billion) in sales for the first quarter of 2025, down 11% from the previous quarter but up 42% from the like period a year ago. The company posted 8.1 trillion won (US$5.65 billion) in net profit for the quarter, up 1% from the previous quarter and up 323% from the like period a year ago.

SK Hynix’s sales and operating profit were the second highest in the company’s history. Thanks to a boom in the HBM market, SK Hynix has overtaken Samsung for the first time in the worldwide DRAM business in terms of market share, according to Counterpoint Research.

The NAND market, however, remains weak for SK Hynix and its competitors in the market. For DRAM, SK Hynix saw a high single-digit decline in overall bit shipments and flat average selling prices (ASPs) during the quarter.

But SK Hynix continues to see strong demand for HBM. The company has dominated the HBM market with 70% market share, according to Counterpoint.

Micron is also seeing strong demand for HBM, but Samsung is struggling in the arena. Nonetheless, thanks to the AI boom, HBM products are generally sold out in 2025 and possibly even 2026.

SK Hynix maintains its earlier projections that its HBM demand will approximately double in 2025 as compared to 2024. The company continues to ramp up its 12-layer HBM3E products. In addition, SK Hynix is also shipping samples of its 12-layer HBM4 products.

To meet demand for HBM and other products, SK Hynix continues to expand its fab capacity. The company started the construction of its first fab in Yong-in in South Korea during the first quarter. The fab is scheduled to open in the second quarter of 2027. The company’s M15X fab in South Korea is on track to open in the fourth quarter of 2025.

Micron

On March 20, Micron Technology reported mixed results for the quarter, but the company continues to see strong demand for its high bandwidth memory (HBM) products. In fact, Micron remains sold out of HBM products in 2025, with strong demand seen for 2026.

Total revenue was $8.05 billion for Micron’s second fiscal quarter, which ended Feb. 27. This compares to $8.71 billion for the prior quarter and $5.82 billion for the same period last year.

The company reported a GAAP net income of $1.58 billion, or $1.41 per diluted share, for the quarter, compared to $1.87 billion, or $1.67 per share, in the previous period, and $793 million, or $0.71 per share, in the like period a year ago.

For the quarter, Micron beat Wall Street’s estimates. “Micron delivered fiscal Q2 EPS above guidance and data center revenue tripled from a year ago,” said Sanjay Mehrotra, chairman, president and CEO of Micron Technology. “We are extending our technology leadership with the launch of our 1-gamma DRAM node. We expect record quarterly revenue in fiscal Q3, with DRAM and NAND demand growth in both data center and consumer-oriented markets, and we are on track for record revenue and significantly improved profitability in fiscal 2025.”

Demand for HBM was enormous. But the traditional DRAM and NAND markets were a mixed picture. “Fiscal Q2 DRAM revenue was $6.1 billion, up 47% year over year, and represented 76% of total revenue. Sequentially, DRAM revenue decreased 4%, with bit shipments decreasing in the high-single-digit percentage range and prices increasing in the mid-single-digit percentage range as a result of improving portfolio mix,” said Mark Murphy, executive vice president and chief financial officer at Micron Technology.

“Fiscal Q2 NAND revenue was $1.9 billion, up 18% year over year, and represented 23% of Micron’s total revenue. Sequentially, NAND revenue decreased 17%, with bit shipments modestly higher and prices decreasing in the high-teens percentage range. FQ2 NAND bit shipments were above our expectations, driven by higher consumer-oriented shipments,” Murphy said.

For the third fiscal quarter, Micron’s sales are projected to reach $8.80 billion, plus or minus $200 million.

“We forecast calendar 2025 DRAM bit demand growth in the mid- to high-teens percentage range and NAND in the low-double-digit percentage range,” Mehrotra said. “Our capital spending plans remain unchanged at approximately $14 billion for fiscal 2025. A significant portion of our capital investments are focused on multiyear facility investments to support our DRAM and HBM manufacturing, including our Idaho fab, Singapore HBM advanced packaging facility and Taiwan DRAM test facility.”

HBM remains a big market for Micron. “In fiscal Q2, data center DRAM revenue reached a new record. High-bandwidth memory (HBM) revenue grew more than 50% sequentially to a new milestone of over $1 billion of quarterly revenue,” he said.

“We see strong demand for HBM and have once again increased our HBM total addressable market (TAM) estimate for calendar 2025 to over $35 billion. We remain on track to reach HBM share similar to our overall DRAM supply share, on a run-rate basis, in calendar Q4 2025. As previously mentioned, Micron is sold out of our HBM output in calendar 2025. We are seeing strong demand for our HBM supply in 2026 and are in discussions with our customers on agreements for their calendar 2026 HBM demand,” he said.

“Micron’s industry-leading HBM3E delivers a 30% power reduction compared to the competition, and our HBM3E 12-high (12H) has a remarkable 20% power advantage over competing 8H products while providing a 50% higher memory capacity. We have begun volume production of HBM3E 12H and are focused on ramping capacity and yield. We anticipate HBM3E 12H will comprise the vast majority of our HBM shipments in the second half of calendar 2025,” he said.

“We are making good progress on an additional platform and customer qualifications with HBM. Micron HBM3E 8H is designed into NVIDIA’s GB200 system, and our HBM3E 12H is designed into the GB300. In fiscal Q2, we initiated volume shipments to our third large HBM3E customer and anticipate additional customers over time. We expect multibillion dollars in HBM revenue in fiscal 2025,” he said. “Looking ahead, we are enthusiastic about Micron’s HBM4, which will ramp in volume in calendar 2026. Our HBM4 provides a bandwidth increase of over 60% compared to HBM3E.”